- Issue a key demand made by US President Donald Trump as part of the ongoing US-China trade war

- China expected to pass new foreign investment law next week during National People’s Congress

But foreign investment into the world’s second biggest economy have slowed over last decade, which could deprive China of access to advanced technologies and marginalise the country in the development of future global supply chains.

Beijing is trying to lure more foreign capital and technology to support its plan to upgrade its manufacturing industries and boost the development of new, hi-tech sectors.

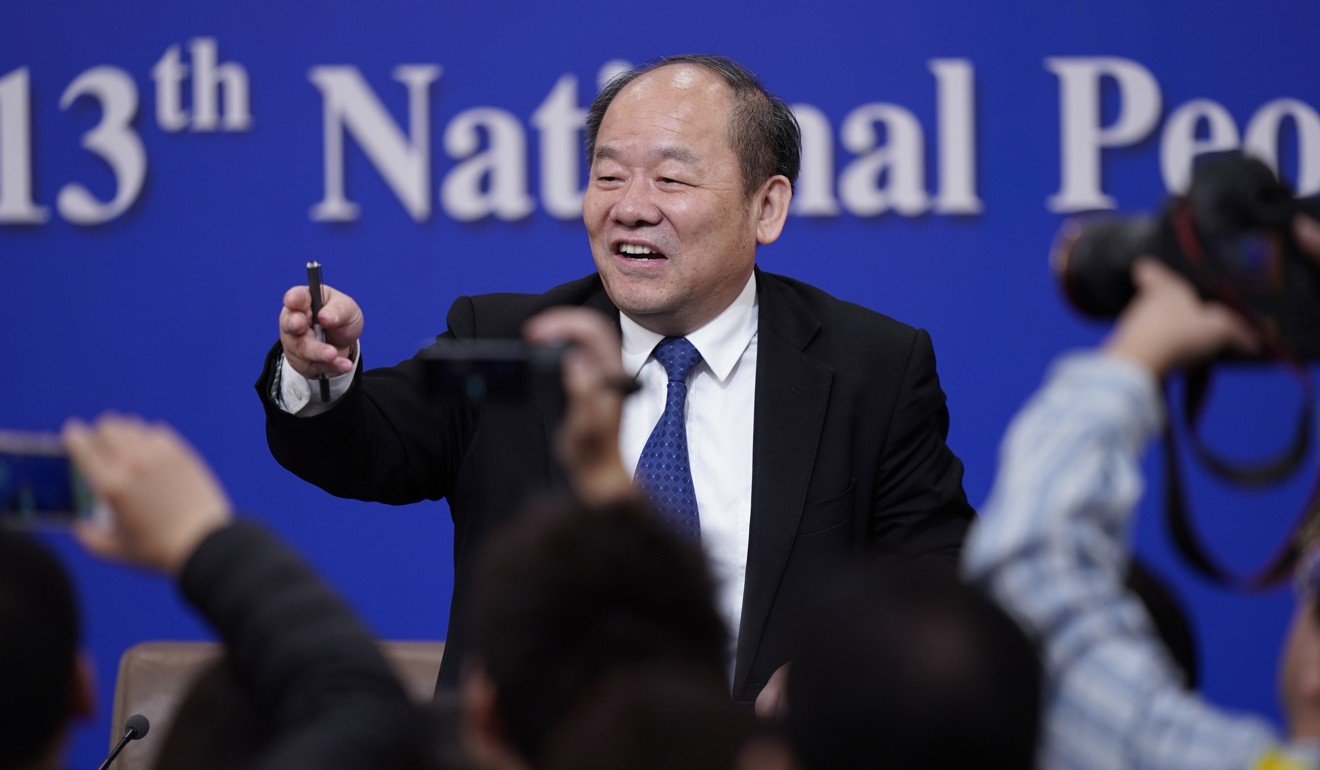

“China will roll out more opening-up measures in the agriculture, mining, manufacturing and service sectors, allowing wholly foreign-owned enterprises in more fields,” Ning said.

“After passing the law, the government will take serious measures to obey and implement it,” Ning added.

He said that China will remove market entry restrictions for foreign investors to ensure that domestic and foreign firms “are treated as equals.”

However, the jury is still out whether Beijing’s promises of fair treatment, market access and protection for intellectual property rights will be enough to generate a steady inflow of hi-tech investment.

The US has long complained that China has been unwilling to implement previous commitments under the World Trade Organisation to open up its market – allegation Beijing denies.

Shen Jianguang, chief economist at JD Digits, an arm of Chinese e-commerce firm JD.com, said restrictions on foreign investment will exist in China despite the government’s promises.

China’s domestic market remains large and attractive for some foreign investors, he said.

“Foreign investors are still very interested in the Chinese market, if the openness of the economy is sufficient,” Shen added.

Source: SCMP

Leave a comment