China’s pharmaceutical industry – shaken by drastic price cuts from Beijing’s recent pilot roll-out of state hospital bulk purchase open bidding – will need to go through painful restructuring and raise big sums to fund innovation, according to executives.

As Beijing’s pilot reform spreads nationwide to cut prices of drugs and improve their efficacy and safety, companies are under mounting pressure to invest in innovative drugs development and reduce reliance on low profit products that are the same copies of original drugs.

That is because the reform means generic drugs manufacturing – the cornerstone of the industry – has become much more competitive.

“The industry and investors need to get used to the new environment in China, where generic drugs are a tool for lowering medical costs,” China Pharmaceutical Innovation and Research Development Association executive president Song Ruilin said in an interview at the sidelines of the JP Morgan Healthcare conference – the world’s largest – in San Francisco last week.

“To survive this, companies need to innovate,” he said.

Early last month, the first round of price bidding in 11 cities saw prices slashed by 62 per cent on average, according to Guoyuan Securities, raising concerns about the industry’s profitability. Two drugs saw prices fall by over 95 per cent.

This sent Hong Kong-listed mainland pharmaceutical firms’ share price down sharply, extending a sector-wide correction that saw the Hang Seng Mainland Healthcare Index nearly halved in seven months from an all-time high in late May.

The stakes are high. The nation’s hospital drugs market is estimated to be worth 800 billion yuan (US$118 billion) last year and is forecast to exceed 1.2 trillion yuan in 2021, according to a Credit Suisse research report.

The winners will be given up to 70 per cent of the local hospital system’s procurement volume. That will only increase as the drugs become more affordable.

Most, except those in the extreme price cut cases, are expected to come out better off as volume gains and unit cost savings are expected to more than offset lower prices.

Direct, centralised procurement will also cut out layers of hefty drugs marketing and distribution costs, bringing additional savings.

Losers will not only be subject to price caps set by the winning bids, they will also have to contend with the need to fight among themselves for the remaining 30 per cent of market that requires significant marketing and distribution costs to serve.

The entire industry will see lower profit margins than the over 30 per centprior to pricing reform, Everbright Securities analyst Lin Xiaowei noted in a report.

“Many generic drug makers will be wiped out in the process if they can’t pass bioequivalence [efficacy and safety] tests, or be selected as winners in the bulk procurement tenders,” said cancer drugs developer Innovent Biologics co-founder and chairman Michael Yu Dechao. “The clean-up will leave more room for innovation.”

To thrive in the environment, drug makers will have to focus on a smaller number of generic products where they have a clear cost advantage, while investing to develop new innovative drugs that will enjoy patent protection from competition.

Although some of the price reductions appear excessive, Song believes regulators will fine-tune their policies, as overly low prices raise the risk of compromises on drug quality.

“Reform needs to be done step by step. Now we have had a start, and the sky has not fallen. It only created a scare,” he said. “I believe the authorities are also reflecting on the results … price reduction is not its only objective.”

For generic products where some Chinese companies have attained western or Japanese standards while others have not, Song suggested that regulators give a 10 to 15 per cent price increment above the winning bids to the winners with international standards, so as to encourage industry quality improvement.

As the pricing reform spreads nationwide, the better resourced companies will be driven to spend billions of yuan each year in attempts to be the first to come up with a new compound that act on a new biological target to treat a disease. They will be rewarded by multi-year legal protection against competition.

Others that failed to do so will try to find an alternative compound – so-called “me-too drugs” – to act on the same target, and sell at a lower price to grab market share.

Many will place bets on their drug candidates, which if successfully developed ahead of rivals, will become blockbuster products and multi-year cash cows thanks to a burgeoning middle class that can afford better and costlier medicine.

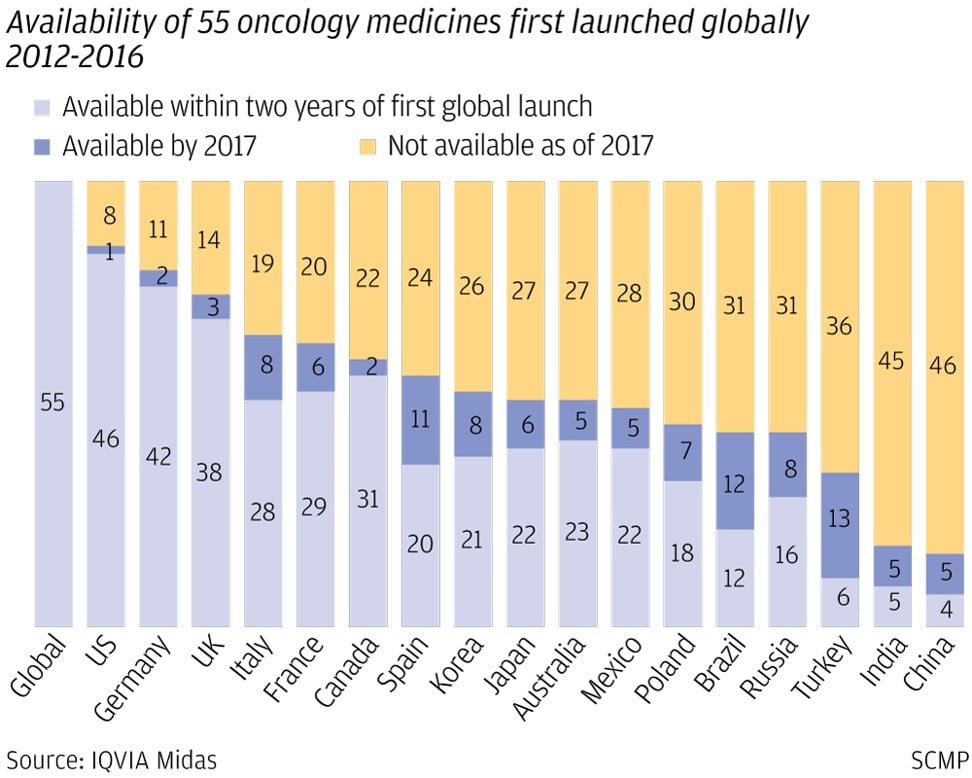

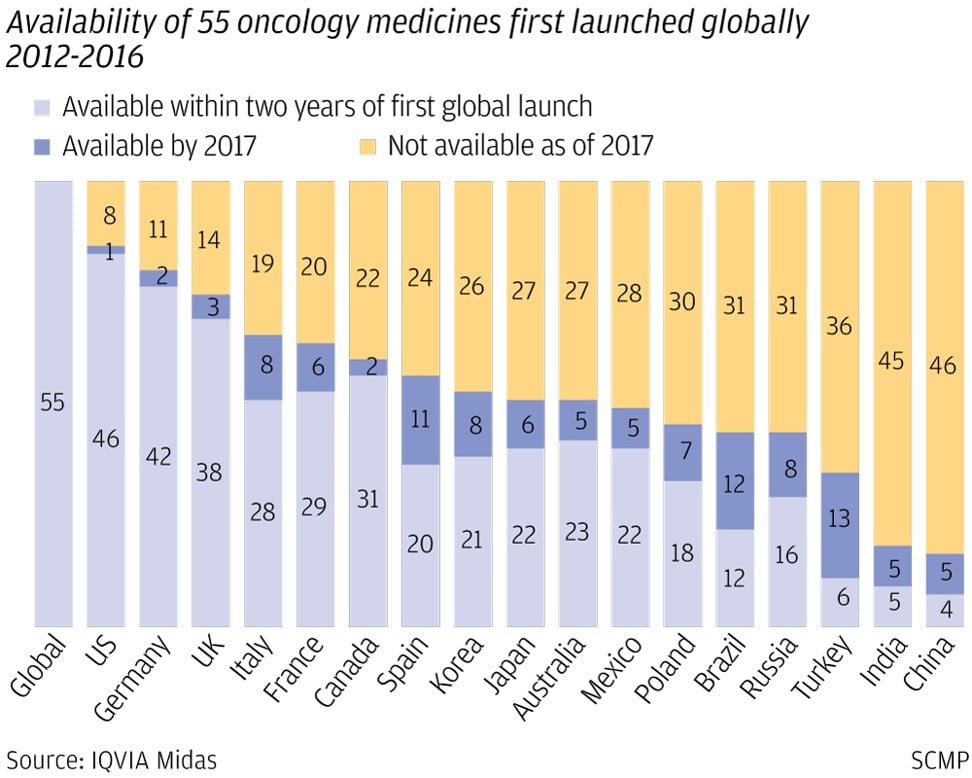

China’s drug makers still have a long way to go to become a truly innovative industry.

Song pointed out that even among the most advanced pharmaceutical companies in the nation, some 80 per cent of their enterprise value has been derived from generic products and the rest from new drugs development.

This proportion is reversed among the big drug firms in the US, the world’s largest and most innovative pharmaceutical market, he added.

This, together with demographic and economic trends, mean tremendous room for growth and investment.

“China has entered prime time for health care industry development, especially biotechnology, thanks to the gradual maturing of the nation’s 300 million-strong middle class as health care consumers, especially those born in the 1950s and 1960s who are wealthy and soon entering old age,” said Houston Huang Guobin, JP Morgan Chase & Co’s head of global investment banking for China.

Johnson & Johnson still bullish on Chinese health care industry

This is especially the case for expensive therapies for cancer patients, whose number in China is projected by Frost and Sullivan to rise to 5.8 million in 2030 from 4.3 million last year.

The market for PD-1 and PD-L1 antibodies alone – a class of cutting-edge novel immuno-oncology therapies that stimulate the body’s immune system to kill cancer cells and cost half a million yuan per year – is forecast by the business consultancy to jump to 56 billion yuan in 2023 from nothing last year.

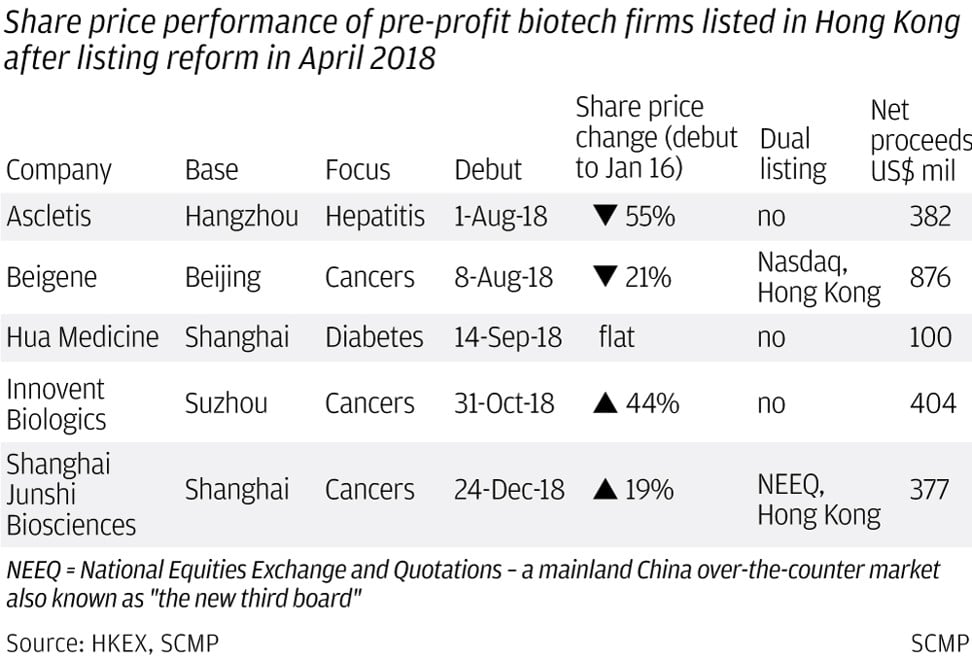

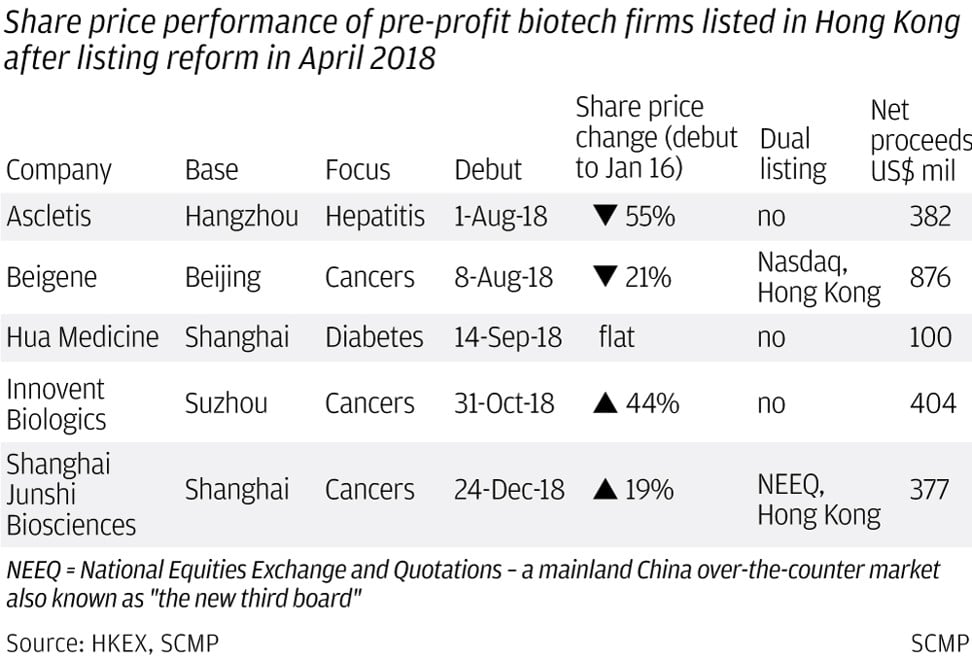

Three of the five companies so far listed in Hong Kong under revamped listing rules have completed clinical trials on their PD-1 antibodies, and submitted the results to regulators for commercialisation approval.

Hong Kong, a new overseas fund-raising conduit for Chinese companies to fund costly drugs discovery and development, stands to benefit from the industry transition, but not without its own growing pains.

Hong Kong Exchanges and Clearing, which last April revised listing rules to allow biotechnology firms that have yet to generate any profit or even revenue to list, has been busy marketing the new listing regime.

Its senior executives – led by chief executive Charles Li Xiaojia – this month embarked on a North America roadshow to meet listing hopefuls and investors covering Vancouver, San Francisco, New York and Boston, HKEX senior vice-president Issuer Services Michael Chan told the South China Morning Post by teleconference on Wednesday from New York.

A year ago, it only did marketing in San Francisco ahead of the regime’s launch late April.

“This time around we are getting more interest from US-based listed companies looking at the Hong Kong listing option to complement their China or Asia strategy … it is not just China-based US-listed firms considering coming back for a dual listing or business spin-off,” he said.

His comment came barely two weeks after Stealth BioTherapeutics, a US-based and Hong Kong investor-backed biotech firm, filed to list on Nasdaq and let its Hong Kong listing application filed six months earlier lapse.

Chan said he believes that is an individual case which by no means suggests that Hong Kong has fallen out of favour as a biotech listing venue, adding he has not received many enquiries about that case during his roadshow.

Why most small players may not survive China’s pharmaceutical industry consolidation

Stephen Peepels, head of US Securities Asia-Pacific, Hong Kong at international law firm Hogan Lovells, agreed.

“As the first couple of companies that took advantage of the new rules [in Hong Kong]didn’t quite perform as well as hoped, it might have prompted some companies to reconsider their choice of IPO venue,” he said. “It would be pre-mature at this time to look at individual examples and start concluding that everybody is going to change their mind and focus on Nasdaq again. It may just take longer to see a lot of deals than many people have expected.”

So far, five companies have listed in Hong Kong under the new rules, while five more have applied but yet to sell shares and list.

The first one, hepatitis drugs developer Ascletis Pharma, which listed early August, saw its share price halved just over two weeks after market debut, triggering criticism of overly aggressive pricing.

“It is an issue of supply and demand, but it also reflects a degree of immaturity on the investment banking and stock analysis sides which allowed this kind of pricing to happen,” said Samantha Du, chief executive of Shanghai-based drugs developer Zai Lab.

“In the US, where there are 2,000 biotech listed firms and stock prices are driven by companies’ performance, very rarely do you see that kind of volatility,” added the former venture capitalist who sits on a panel that assists the Hong Kong stock exchange in its review of biotech listing applications under the new rules.

Why China is going all out to invent new, stronger, cheaper drugs

“Everything needs to start from somewhere, it is hard to have it perfect right at the beginning … it is a process of trial and error … overall there are more positives than negatives,” she said.

JP Morgan’s Huang said it will take time to build up the “ecosystem” as Hong Kong lacks bankers, lawyers, auditors and investors experienced in biotech firms.

To capture the growth opportunities and to augment its market share in China where it is less prominent as a leading investment bank as in its home market the US in the health care sector, he said the bank plans to “increase significantly” its bankers headcount in the broad “health care services and technology” category in China.

While noting Shanghai’s plan to introduce a new science and technology innovation board this year, which may allow international investors to participate and feature a more market-oriented and less cumbersome listing vetting process, he said Hong Kong’s advantages as an open international market will stay and its role will not be taken away in the foreseeable future.

Shanghai-based PegBio, a drug developer for metabolic syndrome conditions such as diabetes, nonalcoholic fatty liver disease (NAFLD) and obesity that is seeking to go public within this year, is hedging its bets and will consider all three options – Hong Kong, Nasdaq and the proposed Shanghai board, said chief executive Michael Xu Min.

Having raised around US$60 million private capital since inception a decade ago, it aims to develop and commercialise three to five products within five years.

Some 10.9 per cent of China’s adult population was estimated to be diabetic in 2013 while 35.7 per cent was pre-diabetic – with high blood sugar and likely to become diabetic, according to a Peking University and Chinese Center for Disease Control and Prevention study with over 170,000 participants published in 2017.

Around half of patients suffering from nonalcoholic steatohepatitis (NASH) – a type of NAFLD – are also diabetic, Xu said.

PegBio aims to complete a phase two type 2 diabetes drug clinical trial involving 450 patients in China and the US by the end of this year, and commercialise it by 2022.

“Rising living standards and changing eating habits have resulted in major increases in incidences of metabolic diseases,” he said. “So far, there is no cure and drugs can only help control the symptoms and slow down their development.

“We aim to develop drugs that are better than current ones on efficacy, safety, ease of use and affordability.”

Source: SCMP

COMMENTS: 3