Image copyright GETTY IMAGES

Image copyright GETTY IMAGESUS President Donald Trump is expecting a raucous welcome on his first official state visit to India on Monday and Tuesday.

He follows a long line of leaders who have made the journey. Some of his predecessors were greeted enthusiastically; others stumbled through diplomatic gaffes; one even had a village named after him.

Can history be a guide to how this diplomatic tryst might go? Here’s a brief look at past visits, ranked in order of how they went.

The good: President Eisenhower

Let’s begin at the beginning.

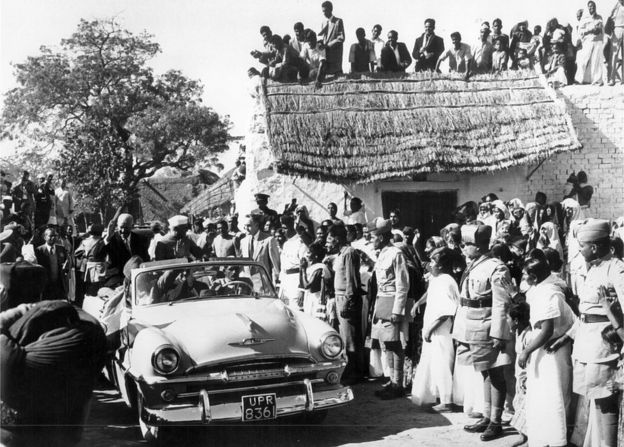

Dwight D Eisenhower, the first US president to visit India, was greeted with a 21-gun salute when he landed in the national capital, Delhi, in December 1959. Huge crowds lined the streets to catch a glimpse of the World War Two hero in his open-top car – Mr Trump is expecting a similar reception in Ahmedabad city, where he will be doing a road show.

Image copyright US EMBASSY ARCHIVES

Image copyright US EMBASSY ARCHIVESThe warmth between President Eisenhower and Indian Prime Minister Jawaharlal Nehru helped during what was a rocky phase in US-India ties. This was early in the Cold war, when the US and Pakistan had become become close allies, and India insisted on staying neutral or “non-aligned”. Like today, relations with China were at the core of the India-US equation, with Washington pressuring Delhi to take an aggressive stance with Beijing on the issue of Tibet.

But, on the whole, Eisenhower’s four-day trip was billed a success. And nearly every US president on a state visit to India has emulated his itinerary: he laid flowers at Mahatma Gandhi’s memorial, took in the splendour of the Taj Mahal, addressed parliament and spoke at Delhi’s iconic Ramlila grounds, which, according to one news report, attracted one million people.

When he left, Nehru said he had taken with him “a piece of our heart”.

Image copyright US EMBASSY ARCHIVES

Image copyright US EMBASSY ARCHIVES The game-changer: Bill Clinton

The game-changer: Bill ClintonIf there was a game-changing visit, it would be Bill Clinton’s in March 2000 with Prime Minister Atal Bihari Vajpayee. Mr Clinton’s arrival came after a two-decade lull – neither Ronald Reagan nor George Bush Snr made the journey East. It came at a tricky time as Washington had imposed sanctions on Delhi following its 1999 test of a nuclear bomb.

But, according to Navtej Sarna, a former Indian Ambassador to the US, the five-day trip was “a joyous visit”. It included stops in Hyderabad, a southern city that was emerging as a tech hub, and Mumbai, India’s financial capital. “He came and saw the economic and cyber potential of India, and democracy in action,” says Mr Sarna.

Image copyright GETTY IMAGES

Image copyright GETTY IMAGESThe country’s reaction is perhaps best expressed in this New York Times headline: “Clinton fever – a delighted India has all the symptoms.”

The nuclear deal: George W Bush

George W Bush, as Forbes magazine once put it, was the “best US president India’s ever had”. His three-day visit in March 2006 was a highlight in the two countries’ strategic relationship – especially in matters of trade and nuclear technology, subjects they have long wrangled over. His strong personal dynamic with Prime Minister Manmohan Singh was hard to miss – after he left office, Mr Bush, a keen artist, even painted a portrait of Mr Singh.

The two leaders are credited for a historic but controversial nuclear deal, which was signed during Mr Bush’s visit. It brought India, which had for decades refused to sign the Nuclear Non-Proliferation Treaty (NPT), out of isolation. Energy-hungry India got access to US civil nuclear technology in exchange for opening its nuclear facilities to inspection.

Image copyright US EMBASSY ARCHIVES

Image copyright US EMBASSY ARCHIVESDouble visit: Barack Obama

Barack Obama was the only president to make two official visits. First, in 2010 with Prime Minister Manmohan Singh, and then in 2015 with Prime Minister Narendra Modi.

On his first visit – in a break from the past – he landed in Mumbai, instead of Delhi, with a large trade delegation. This was not just about economic ties but a show of solidarity following the Mumbai terror attacks of 2008, which killed 166 people. Mr and Mrs Obama even stayed at the Taj Mahal hotel, one of the main targets.

It was significant that the US president declared support for India to join a reformed and expanded UN Security Council, says Alyssa Ayres, a former US deputy assistant secretary of state for South Asia. “That all these years later nothing has changed in the UN system is another matter, but that was a major policy shift for the United States.”

Image copyright US EMBASSY ARCHIVES

Image copyright US EMBASSY ARCHIVESThe not-so-good: Jimmy Carter

Although Jimmy Carter’s two-day visit in 1978 was a thaw in India-US relations, it was not free of hiccups.

With some 500 reporters in tow, Carter followed a packed itinerary: he met Prime Minister Morarji Desai, addressed a joint session of parliament, went to the Taj Mahal, and dropped by a village just outside Delhi.

The village, Chuma Kheragaon, had a personal connection: Carter’s mother, Lillian, had visited here when she was in India as a member of the Peace Corps in the late 1960s. So when Carter and his wife, Rosalynn, made the trip, they gave the village money and its first television set. It was even renamed “Carterpuri”, a moniker it still holds.

Image copyright US EMBASSY ARCHIVES

Image copyright US EMBASSY ARCHIVESIn a leaked conversation that made headlines and threatened to derail the visit, Mr Carter promised his Secretary of State, Cyrus Vance, a “very cold and very blunt” letter to Desai. The two leaders signed a declaration, promising greater global co-operation, but Carter left India without the assurances he had hoped for.

The ugly: Richard Nixon

Richard Nixon was no stranger to India when he arrived in August 1969 for a day-long state visit. He had been here as vice-president in 1953, and before that on personal trips. But, by all accounts, he wasn’t a fan.

“Nixon disliked Indians in general and despised [Prime Minister] Indira Gandhi,” according to Gary Bass, author of Blood Telegram: Nixon, Kissinger and a Forgotten Genocide. And, he adds, the feeling was said to be mutual.

This was also at the height of the Cold War, and India’s non-alignment policy “appalled” American presidents. Mr Bass says that under Gandhi, India’s neutrality had turned into a “noticeably pro-Soviet foreign policy”.

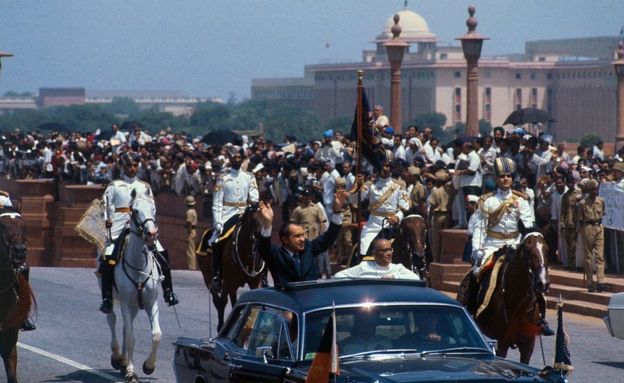

Image copyright GETTY IMAGES

Image copyright GETTY IMAGESAnd the future: Donald Trump

The US and India have certainly had their ups and downs, but during the last official visit in 2015, Mr Obama and Mr Modi signed a declaration of friendship: “Chalein saath saath (Let’s move forward together)…” it began.

President Trump’s visit will take the relationship forward, but it’s unclear how.

Image copyright AFP

Image copyright AFPHis arrival in Ahmedabad, the main city in PM Modi’s home state of Gujarat, followed by a big arena event, is expected to draw a massive crowd. It will echo President Eisenhower’s rally in Delhi years ago, perhaps cementing the personal ties between the two leaders.

But while Mr Trump’s trip will be packed with pageantry, it could be light on policy. Unlike other presidential visits, this one is not expected to yield concrete agreements, with the trade deal Mr Trump so badly wants looking unlikely.

Source: The BBC