04/10/2019

Chinese geologists think they have formula that could help to increase control of market in the elements hi-tech industries depend upon

- Simple combination of clay mined for porcelain production, granite bedrock and acid rain could point to lucrative sources of rare earths

China has 80 per cent of the reserves of rare earth elements the world needs to keep talking on its smartphones, and geologists in Guangzhou think they know why. Photo: EPA

Geologists in southern China say they have isolated a series of critical factors that could make it easier to find

rare earth elements used in hi-tech consumer goods such as smartphones.

China has more than 80 per cent of the world’s reserves of heavy rare earths such as terbium, dysprosium and holmium concentrated in a few provinces to the south of the country.

The reason for the concentration is one of the biggest puzzles in geology, but researchers at the Guangzhou Institute of Geochemistry in Guangdong province say the answer may be found in a combination of clay deposits, acid rain and granite that is distinctive to southern China.

Professor He Hongping and his colleagues came to the conclusion by testing the interaction between rare earths and different types of clay. Through their research they found that kaolinite – or china clay – was the best at absorbing rare earths from water.

The clay, named after Gaoling village near Jingdezhen, a centuries-old ceramic production centre in east China’s Jiangxi province, is a raw material for porcelain production.

While kaolinite is found in many countries, those places do not have rare earth deposits – probably because of the lack of acid rain, He said.

“You need the right environment.”

He said that rocks that contained tiny amounts of rare earth elements weathered faster in an acid environment, but the acidity could not be too high or the rare earth might run off before it could be captured by the clay.

Why Beijing cut tax rate on rare earths amid trade war

Rainwater with the right natural acidity often occurred in areas around 20 degrees latitude, such as southern China, he said.

The last step was to locate the source rock. Granite formed in volcanic eruptions between 100 million and 200 million years ago is considered to be the main source of rare earths.

He said that part of the Pacific tectonic plate containing rare elements might have been forced under the Eurasian Plate and was pushed to the surface as magma that formed rocks.

Other countries could learn from the Chinese experience, said He, whose team submitted their findings to the research journal Chemical Geology.

Recent discoveries in Vietnam, Australia and North Carolina in the United States conformed to the Guangzhou team’s theory, but there was still more research to do, he said.

“Rare earth deposits are quite unlike minerals such as copper. Sometimes they occur in this mountain but not in another nearby with almost the same geological features.

Sometimes they occur in one half of the mountain but not in the other.”

With China and the US engaged in a trade war, and Beijing cutting taxes on mining companies looking for these elements, the pressure was on to unlock the secrets of China’s abundant rare earth deposits, he said.

Does China’s dominance in rare earths hold leverage in trade war?

Dr Huang Fan, associate researcher with the China Geological Survey, said the Guangzhou discovery would help geologists to find more rare earths.

Most rare earth mines were located along the borders between provinces such as Guangdong and Jiangxi, but recently there were discoveries on a plateau in Yunnan province, where few geologists believed rare earths could be found, he said.

“There are many more rare earth deposits out there waiting for us.”

Source: SCMP

Posted in Acid rain, Australia, ceramic production centre, Chemical Geology, China alert, China Geological Survey, Chinese geologists, clay, control, copper, discovered, dysprosium, elements, Eurasian Plate, formula, Gaoling, geologists, granite bedrock, guangdong province, Guangzhou, Guangzhou Institute of Geochemistry, hi-tech industries, holmium, Jiangxi Province, Jingdezhen, kaolinite, lucrative sources, market, mined, need, Pacific tectonic plate, porcelain production, rare earth elements, rare earths, rich, scientists, smartphones, terbium, Uncategorized, United States, Vietnam, World |

Leave a Comment »

15/09/2019

- Facial recognition technology helped officers narrow down search to building in Nantong, but they were unable to tell which room suspect was in

- Police went door-to-door hunting for the smell of hotpot after fugitive was spotted buying ingredients at market

Eating hotpot can be a hot and sweaty business. Photo: Shutterstock

China’s facial recognition technology is now so advanced that it can positively identify 98.1 per cent of human faces and within 0.8 seconds, according to China Daily.

But the latest case of unconventional detective work comes from the eastern province of Jiangsu, where local police used their faces, not their target’s, to locate their man – specifically their noses. Call it olfactory recognition.

Jiangsu police had been looking for a man named Guo Bing, who was suspected of gang crimes, fraud and extortion and had been on the run in the city of Nantong since police there cracked down on gang-related activity in late May, local media reported on Tuesday.

Police used facial recognition to figure out which Nantong building Guo was living in, but they did not know which flat.

So they put in 24-hour camera surveillance and spotted Guo going to a local market on Saturday afternoon and buying ingredients for hotpot.

“We saw him buying vegetables and hotpot soup base at a market one afternoon,” Ge said, “so we guessed he was going to have hotpot that day.”

Police narrowed down the search to the seventh floor of the building, then started sniffing at each door. When they registered the unmistakable aroma of hotpot, they knew they had their man.

Television footage of the bust showed police descending on the surprised and shirtless man – eating hotpot is a messy and sweaty business – and being hauled away.

Source: SCMP

Posted in case, China Daily, chinese police, detective work, extortion, facial recognition technology, fraud, Fugitive, gang crimes, hotpot, ingredients, Jiangsu, Jiangsu police, literally, market, Nantong, olfactory recognition, smell, sniff out, telltale hotpot, Uncategorized, unconventional |

Leave a Comment »

18/08/2019

- Adult consumers are fuelling a boom in China’s toy collectibles market

- Men are spending thousands of dollars on figurines to express their identity, boost their street cred, and indulge their inner kid

Chinese collector Don Tang with artist Jason Freeny at the Jason Freeny X-Soul Station exhibition in Shanghai. Photo: Don Tang

Don Tang is proud of his toys. So much so that the Shanghai resident, 32, puts them on display both in his home and in the office of the company he runs.

And there are plenty to display. Tang, 32, has some 100 collectibles and the number is growing all the time. Each month he sets aside 2,000 yuan (US$280) to buy the top trending toys, newest releases, or one-of-a-kind items – either from physical stores, online or at toy conventions in China.

But the toys are not connected to his work as the CEO of a firm in the intellectual property sphere. They are simply a hobby, albeit one Tang takes seriously. The crowning jewel of his collection? A 6,000 yuan KAWS action figure bought in Tokyo, Japan.

“When I return home from work each day, I get to see [my toys] and it puts me in a good mood,” says Tang, who realises some people might not get the appeal of his hobby, but says it is an “addictive” pursuit and a way of appreciating designs and craftsmanship. Whether it’s SpongeBob SquarePants, Hello Kitty or Sesame Street, each toy has its own distinct, “lovable, cute, and personalised” identity, he says.

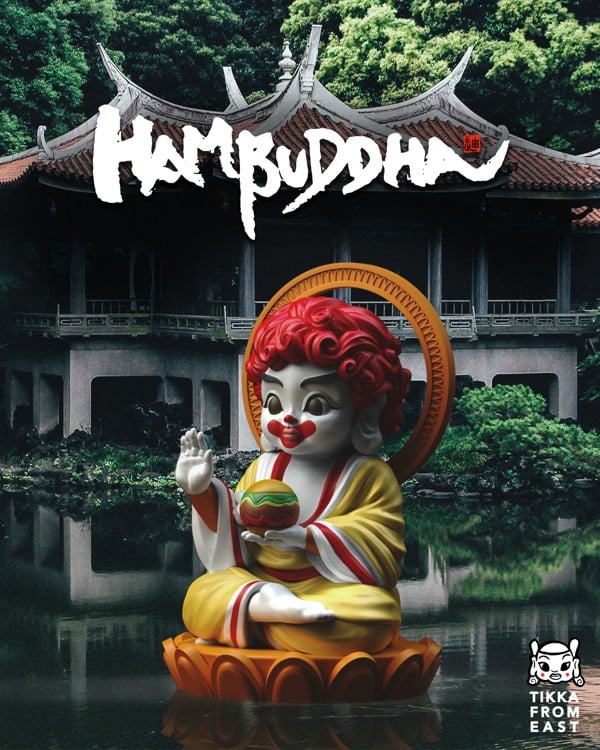

Remind you of someone? Hambuddha is a designer figurine made by Mighty Jaxx of Singapore that is aimed at the adult market. Photo: Mighty Jaxx

“When you look back at the toys that you collected at different times, you realise how your own aesthetic, tastes, and preferences have changed over time,” adds Tang, who would never dream of selling his precious collection.

Tang’s toy story is far from unique. Sales of toys and games in China – which produces 80 per cent of all the world’s toys – soared to 324 billion yuan in 2018, up from 135 billion yuan in 2013, according to market research company Euromonitor. Fuelling these sales is a growing army of toy connoisseurs just like Tang.

Mighty Jaxx, a Singapore-based urban culture company that designs and manufactures collectibles and lifestyle products, is among the many companies benefiting from this surge in demand.

Its Chinese customer base accounts for 25 per cent of its projected revenue of S$10 million (US$7.21 million) for 2019 – and this proportion is expected to hit 40 per cent over the next few years, according to Mighty Jaxx’s founder and CEO, Jackson Aw, 30.

Smearing cannabis on your face: the latest Asian beauty craze

An avid toy collector himself, Aw first mused over the idea of turning his hobby into a viable business back in 2012. He ventured to Shenzhen in China for one month, knocking on factory doors just for a behind-the-scenes glimpse of the toy production process.

Being one of his first times to China, the mammoth scale of the industry came as a major “culture shock” to Aw.

Mighty Jaxx founder and CEO Jackson Aw. Photo: Toh Ee Ming

“I had always thought that it was just one giant machine that spits out parts and that was it. But there were rows and rows of hundreds of people printing, hand painting, assembling and using different skills just to produce one toy,” the Singaporean says.

Describing the visit as his “greatest education”, Aw was inspired to launch Mighty Jaxx from his bedroom with start-up capital of S$20,000 loaned from a bank through his parents.

Fast forward to today and his online business has worked with major brands such as Warner Brothers, DC Comics, Cartoon Network, MTV and New Balance, and shipped millions of products to collectors in over 50 countries. It is best known for its XXRAY figures, developed in partnership with artist Jason Freeny, which feature dissected Justice League characters such as Batman, Superman and Wonder Woman.

Hong Kong toy makers hope Asia’s largest toy fair will help boost flagging sales

But in its early days, the China market had intimidated Aw as a “big anomaly” that was still largely closed off. Aw had found it difficult to navigate the cultural norms and familiarise himself with unfamiliar business models.

Still, sensing China’s potential, his firm embarked on wide-ranging creative collaborations to tailor its offerings to the Chinese market – from creating yin-and-yang themed toys, celestial chicken fairy deities and the “Hambuddha” (a Buddha holding a pearl-shaped hamburger while on a lotus throne).

It also partnered with Chinese artist Chen Wei (who goes by the alias Cacooca) to develop a new Panda Ink collection, which depicts a panda in the midst of an everyday activity or hobby, such as hiking, playing video games or cuddling with cats.

Mighty Jaxx’s ‘Flow by 18 Uppercut’ has a yin and yang theme with white and black halves. Photo: Mighty Jaxx

It has also collaborated with other big-name artists and celebrities trending among Chinese consumers – such as Los Angeles-based dance crew Kinjaz, who found fame in China appearing on dance shows, and ABS, a leading graffiti crew based in Beijing’s 798 Art District – and has an upcoming collaboration with Taiwanese singer Show Luo.

But it is the comic and toy conventions that provide its biggest fans, typically men in their 20s to 40s who flock in from Beijing, Shanghai and Guangzhou.

Aw says these collectors have a huge appetite to splurge on high-end collectibles, which can range in cost from anywhere between US$10 to US$2,000.

Singapore sex toy sales buzzing thanks to ‘healthy’ branding

To these collectors, price is of little concern as they are looking for “tangible products to buy and show off their personality” and build their street cred among their friends, though they still prefer to stay under-the-radar about their collection to the general public, Aw says.

Today, Mighty Jaxx’s products are manufactured in nearly 20 different factories in Shenzhen and Guangzhou. It set up its first overseas office in Shanghai last year and is planning to open its second one in Suzhou by the end of 2019, according to Aw.

Besides growing Chinese affluence, Aw credits his company’s success to a greater exposure to Western influences and China’s own unique brand of pop culture taking off domestically.

He points to one of China’s biggest blockbusters Monster Hunt, a fantasy martial arts film of how monsters live among humans.

Mighty Jaxx’s celestial chicken fairy deity is aimed at the Hong Kong and mainland China market. Photo: Mighty Jaxx

“Outside China, you wouldn’t know what the hell it’s about. But the Chinese are creating their own unique narrative and developing their own intellectual property … That’s when we know the demand for original creation in different forms is truly there,” Aw says.

Likewise, consumers live in an age of a “mishmash of pop cultures and crossovers” and “subcultures becoming mainstream”, he says.

Citing how the business has teamed up with Team Hero, a China e-sports team comprising professional computer gamers, to roll out new figurines, Aw says: “It doesn’t mean that tattoo artists, skateboarders don’t buy toys … What seems to be separate demographics are converging to become a multibillion-dollar market.”

Aw says the company is planning to expand from its current business model based on direct selling to collectors, to e-commerce distribution channels like Taobao and Tmall by the end of 2019.

He hopes eventually to set up the firm’s first retail store in Shanghai, as he believes the future lies in experiential retail.

“China has been cultivating that openness in recent decades, and we’re still very curious and excited for new things to happen [in this market],” Aw says. ■

Source: SCMP

Posted in ABS, adult male consumers, Batman, Beijing, cannabis, Cartoon Network, celestial chicken fairy deity, Chinese toys boom, collectibles, consumers, crossovers, cuddling with cats, DC Comics, demographics, Euromonitor, everyday activity, figurines, fuelled by, Guangzhou, Hambuddha, hand painting, Hello Kitty, hiking, hobby, Hong Kong, humans, inner kid, Intellectual property, Jason Freeny X-Soul Station exhibition, Justice League characters, Kinjaz, Mainland China, mainstream, market, martial arts film, Mighty Jaxx, mishmash, Monster Hunt, monsters, MTV, New Balance, original creation, Panda Ink, playing video games, pop cultures, Printing, retail store, Sesame Street, sex toy sales, Shanghai, Shenzhen, Singapore, Singaporean, skateboarders, SpongeBob SquarePants, street cred, subcultures, Superman, Taobao, tattoo artists, Team Hero, Tmall, toys, Uncategorized, Warner Brothers, white and black halves, Wonder Woman, XXRAY figures, yin and yang theme |

Leave a Comment »

30/07/2019

LONDON (Reuters) – Reckitt Benckiser (RB.L) cut its full-year revenue target after reporting lower than expected second-quarter sales in its last quarter under long-time chief executive Rakesh Kapoor, hurt by a surprise slowdown in demand for infant formula in China.

Shares of the British household goods maker, which had risen the previous day to near their highest level for the year, fell as much as 5.7% in early trade.

The Durex condom and Lysol disinfectant maker said it now expects full-year like-for-like sales growth of between 2% and 3%, down from its previous target of 3% to 4%.

Reckitt, which maintained its “broadly flat” operating margin target, said slowing birth rates over the past two years and increased competition had led to market share losses for its Enfamil infant nutrition products in China, its biggest market for baby food.

The company is also recovering from supply chain disruptions in China, after technical issues at a baby formula factory in the Netherlands, which supplies the Asian market, prevented it from supplying retailers with formula in the third quarter of 2018.

The disruption forced mothers to turn to rival products and in part helped rival Danone (DANO.PA), which last week reported strong infant nutrition sales in China as its strategy to focus on more premium products paid off.

For Reckitt, the slowdown resulted in a surprise 1% drop in like-for like sales in its health business, even as sales of its over-the-counter products, such as Mucinex cough medicine, rebounded after several quarters of decline.

Analysts were expecting Reckitt’s Health business, which also sells Scholl foot products and Nurofen tablets, to rise 1.3%.

“Within Health, Infant and child nutrition was a big negative surprise,” Bernstein analyst Andrew Wood said, adding he expects the business to grow in the third quarter as it faces an easier comparison with last year.

DISAPPOINTING PERFORMANCE

Overall like-for-like sales were flat in the second quarter, missing the 1.9% growth analysts on average had expected, according to a company supplied consensus.

Net revenue rose 2% to 3.08 billion pounds against analysts’ average estimate of 3.13 billion.

The second-quarter report is the last under Chief Executive Rakesh Kapoor, who in September hands over to PepsiCo executive Laxman Narsimhan.

Kapoor said on a media call he was disappointed by the company’s performance in the first half but was “confident growth would be second-half weighted.”

Kapoor, CEO for the past eight years, said he was bullish that increased investments behind its brands and in medical channels, as well as new products such as Mucinex Night Shift and Enfagrow Pro Mental, and its expansion into new cities in China would help drive that growth.

He also said a plan to split the group into two business units – one for health and one for hygiene and home products – was on track for completion in mid to late 2020.

Still, analysts said the new CEO has a tough task.

“The patchy half-year figures mean the incoming CEO Laxman Narasimhan has a difficult job on his hands to try and put the business back on track, as well as decide the strategic future direction of the group,” investment firm AJ Bell said.

Reckitt shares were down 3% at 6,469 pence by 0830 GMT and were among the biggest losers in the FTSE .FTSE index.

Source: Reuters

Posted in Asian market, baby food, China infant formula, cuts, Danone, demand, Durex condom, Enfagrow Pro Mental, Enfamil infant nutrition products, Health business, household goods maker, Lysol disinfectant, market, Mucinex Night Shift, Nurofen, PepsiCo, Reckitt, Reckitt Benckiser, sales target, slows, the Netherlands, Uncategorized |

Leave a Comment »

21/05/2019

GUANGZHOU, May 20 (Xinhua) — South China’s Guangdong Province abolished an old regulation on the market access of elderly care institutions to boost the development of the industry, local civil affairs authorities said Monday.

A registration and filing system will be put into practice to replace the previous license system, which has been implemented since December 20, 2014, to lower the threshold for setting up elderly care institutions. Social sectors are encouraged to participate in the industry.

The provincial department of civil affairs will issue relevant policy documents on the registration and supervision of elderly care institutions, to further promote services for the aged in Guangdong.

China saw improved elderly care system, with 163,800 elderly care institutions and facilities offering 7.46 million beds for senior citizens as of the end of 2018.

A raft of measures are being taken to accelerate the development of the elderly care service industry, including fully opening the elderly care market by 2020.

Source: Xinhua

Posted in Elderly care, Guangdong, market, open, Uncategorized |

Leave a Comment »

08/03/2019

BEIJING, March 7 (Xinhua) — As China is faced with a growing aging population, the government has pledged to provide better elderly care services and facilities for the silver-haired, and give a strong boost to domestic demand.

Elderly care remains high on the agenda in this year’s government work report, which said that significant steps would be taken to develop elderly care, especially community elderly care services.

The number of people in China aged 60 and above reached 250 million by the end of 2018, accounting for 17.9 percent of the country’s population.

“Growing demand will trigger greater market potential in China’s senior care industry,” said Tang Wenxiang, founder of Fullcheer Group, a major elderly care services provider based in Changsha, capital of central China’s Hunan Province.

Fullcheer Group has 50 branches in more than 10 provinces and cities with a total of 5,000 beds. Tang expects the number of his company’s beds to increase to 50,000 in five years.

“There is still a huge gap between the demand of China’s aging population and the number of elder care facilities,” Tang said.

The country will provide support to institutions offering services in the community like day care, rehabilitation care, and assisted meal services and outdoor fitness services using measures such as tax and fee cuts and exemptions, funding support, and lower charges for water, electricity, gas and heating, according to the government work report.

Tang said government’s measures to develop elderly care services greatly boosted the confidence of entrepreneurs who run businesses in the sector.

Developing the elderly care industry is good for improving people’s well-being and stimulating consumption, said Xu Hongcai, an economist with the China Center for International Economic Exchanges.

“Consumption on elderly care requires the supply of the elder care market, offered by both the government and the market,” he said.

A research report issued by Guolian Securities suggests that a string of policies have been carried out in China to encourage the participation of the social sector in the senior care industry, which will boost the country’s consumption in the health and medical sectors.

As China opens this sector, foreign firms such as France’s Orpea and Japan’s Nichii have tapped the elderly service market in China.

China still lacks leading players in the senior care market which includes nursing care, rehabilitation assistive devices and daily necessities for seniors, Tang said.

The long-term care insurance system will help increase the occupancy rate of some elderly services facilities given a number of elderly people can hardly afford the expenses, according to Tang.

Source: Xinhua

Posted in care insurance system, Changsha, China alert, China Center for International Economic Exchanges, consumption, domestic demand, economist, Elderly care, elderly care services and facilities, Electricity, Fullcheer Group, gas, Government, growing aging population, Guolian Securities, health and medical sectors, heating, Hunan Province, market, research report, silver-haired, Tang Wenxian, Uncategorized, water, Xu Hongcai |

Leave a Comment »

21/02/2019

BEIJING, Feb. 20 (Xinhua) — China’s central government will eliminate or delegate to lower-level authorities more items that require government approval and implement nationwide the reform of the construction project reviewing system, the State Council’s executive meeting chaired by Premier Li Keqiang decided on Wednesday.

The Chinese government has put high importance on transforming government functions by streamlining administration, delegating powers, enhancing oversight and providing better services. Premier Li stressed the importance of deepening the reform in transforming government functions, especially by delegating administrative powers.

He called for a thorough evaluation of all government review items to see that all existing review items that can be eliminated or delegated to lower-level authorities be duly dealt with except for those involving national security and major public interests.

“Streamlining administration is as important as tax cuts in stimulating market vitality as we tackle the current downward economic pressure. The key task for the government is to foster a better business environment to energize all market players,” Li said at the Wednesday meeting, “This will be our important measure for sustaining steady economic growth this year.”

It was decided at the meeting that 25 administrative approval items including pre-approval of corporate names before business registration and preliminary review of domestically-produced medicines will be canceled. Six administrative approval items including the practising registration of some professions will be delegated to government departments at or below the provincial level.

“Our reform to transform government functions affects the vested interests of government departments. However, administrative streamlining is a must as excessive and cumbersome reviewing requirements would drive up institutional transaction costs and dampen market vitality,” Li said. “Meanwhile, the government must enhance oversight and improve services. Its focus should shift to setting rules and standards.”

It was also decided at the meeting the pilot reform of the reviewing system for construction projects will be rolled out across the nation.

Under unified requirements, an inter-agency reviewing process with a single department acting as the lead agency and clear reviewing timeframes will be adopted. Practices such as pledging of notification, district-wide evaluation, and joint drawing review and project inspection upon completion will be implemented. In a word, there will be “a single blueprint” overseeing the implementation of a project, “a single window” providing multi-agency services, “a single checklist” for preparing application materials and “a single set of mechanisms” for regulating the permitting processes. The goal is to halve the time required for reviewing construction projects to 120 working days in the whole of the country within the first half of this year.

“Market players must assume their due responsibilities and recognize that they take primary responsibility for the projects they undertake, and that they will be held accountable for them on a lifetime basis,” Li said, “As for the government, it must not interfere in things that do not fall within its purview, and focus on exercising oversight in all the areas necessary. This kind of oversight will help ensure fairness and efficiency.”

Source: Xinhua

Posted in Central government, China alert, construction project reviewing system, domestically-produced medicines, inter-agency reviewing process, market, Market players, practising registration of some professions, Premier Li Keqiang, Red tape, State Council, Uncategorized |

Leave a Comment »

23/01/2019

DAVOS, Switzerland, Jan. 22 (Xinhua) — The opening of China’s market is likely to increase the competitiveness of the Chinese economy, which could serve as a future driver of global growth, experts attending the ongoing World Economic Forum (WEF) Annual Meeting said Tuesday.

Attending a penal discussion titled “Rethinking Global Financial Risk,” Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said that the Chinese economy may slow down in 2019 but “it won’t be a collapse.”

“China’s vision for the economy is to make it open, large and competitive. It will be a huge opportunity for all companies,” Fang said, adding that declines in overheated sectors, such as real estate and infrastructure, could provide useful correctives for the market.

Saying that opening up is good for China, Fang emphasized that over the last 40 years China has never had a significant financial crisis.

“How has it managed that? We have a very top-down approach to financial risk management. If risks are accumulating the government will step in. There is a lesson that the rest of the world should look at,” he said.

Jin Keyu, professor of economics of the London School of Economics and Political Science, said only two years ago China was considered as a ticking financial bomb, and the slowdown is the consequence of the government’s successful efforts to deleverage.

“These efforts have made China safer, much of this is the deliberate effort of the government,” she said.

Most of the economic experts predicted economic slowdowns in major global markets, including China and the United States, for 2019, but according to Jin, though growth has become more of an issue, the Chinese government is now shifting its focus to revamping growth.

“China has a lot more scope than most countries in this regard,” she said, adding that China’s main challenge is “how to unleash the real potential of the real economy.”

Ray Dalio, founder of investment management firm Bridgewater Associates, noted that there’s a top-down way of setting a mission, and working those things in a top-down way in China that has produced a 20-fold increase in income.

Chairman of the Swiss bank UBS Axel A. Weber said at the discussion that most of the growth seen globally is “generated by China being included in the world economy.”

“The more we can connect stock markets, the more we can bring international investors into the Chinese economy,” he noted.

Though soft but stable growth characterizes the general outlook for 2019, experts attending the discussion noted that a range of serious risks still exist on the periphery, such as a hard Brexit, climate change, and cybersecurity.

Experts at the discussion also predicted that easing monetary policies and fiscal reforms could offset the slowdown, but with interest rates still at post-financial crisis low points, there are questions about how much room central banks have to manoeuvre.

The 2019 annual meeting of WEF kicked off here Tuesday, bringing together more than 3,000 global leaders from politics, government, civil society, academia, arts and culture as well as the media.

Source: Xinhua

Posted in China alert, global growth, market, Uncategorized, WEF |

Leave a Comment »