- A push to connect Pacific nations highlights a submarine struggle for dominance over the world’s technology infrastructure

- The ambitions of Chinese tech giants like Huawei, which have laid thousands of kilometres of cable, are of increasing concern to Washington

infrastructure, the latest battle is taking place under the Pacific Ocean.

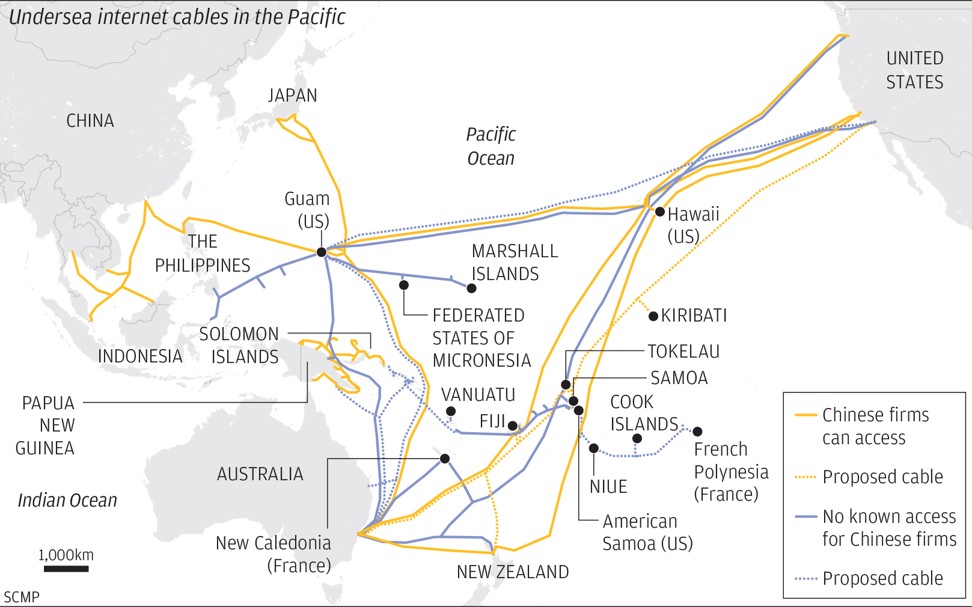

More than US$4 billion worth of cables are to come into service by 2021, continuing a trend in which US$2 billion worth of cables have come online every year since 2016, and six of these cables will connect Pacific Island countries.

over the involvement of Chinese tech companies.

SECURITY CONCERNS

long-standing dominance over global data traffic through investments in subsea cables.

Chinese tech giants like Huawei have entire divisions devoted to undersea connectivity that have laid thousands of kilometres of cable, and Chinese state telecommunication companies such as China Unicom have access to many of the existing trans-Pacific cables.

But a panel led by the US Department of Justice has held up a nearly complete trans-Pacific cable project over concerns about its Chinese investor, Beijing-based Dr Peng Telecom & Media Group.

If these nations want to be part of the international economy, they need reliable communications:

VIRTUALLY REMOTE

For years, as Japan, Hong Kong and Singapore became global hubs of high-speed internet data traffic, the cables criss-crossing the ocean floor passed by just off the shores of Pacific Island countries en route between hubs on either side of the ocean.

Tiziana Bonapace, director of UNESCAP’s information technology and disaster risk-reduction division, said the Pacific Islands remain one of the most disconnected areas in the world, where “a vast proportion of the population has no access to the internet”.

Over the past five years, international organisations like UNESCAP, the Asia Development Bank and the World Bank have been pushing for better connectivity in the region. The World Bank’s Pacific Regional Connectivity Programme has invested more than US$90 million into broadband infrastructure for Fiji, the Federated States of Micronesia, Kiribati, the Marshall Islands, Palau, Samoa and Tuvalu.

DRAWING NEW LINES

In Papua New Guinea, where mobile internet currently reaches less than a third of the population, a partnership between local telecoms company GoPNG and the Export-Import Bank of China funded the new Huawei-built Kumul Domestic cable system, which came online this year.

The Southern Cross Next system, owned by Spark, Verizon, Singtel Optus and Telstra – the same group of shareholders which operates the massive 30,500km (19,000 mile) set of twin cables connecting the US with Australia and New Zealand known as Southern Cross – is planned to come online in 2022, and will connect directly to Fiji, Samoa, Kiribati and Tokelau.

Chinese telecoms company China Unicom counts the existing Southern Cross cables among its network capabilities – meaning it is likely to have access to the cable through a leasing agreement with one of the other companies that uses the cable, according to Canberra think tank the Australian Strategic Policy Institute (ASPI).

WHAT’S NEXT

Natasha Beschorner, senior digital development specialist at the World Bank, said that while there were challenges ahead in terms of broadband access and affordability, increased connectivity was starting to bring new opportunities to the Pacific.

“Digital technologies can contribute to economic diversification, income generation and service delivery in the Pacific,” Beschorner said. “E-commerce and financial technologies are emerging and governments are considering how to roll out selected services online.”

Experts say the industry has recently seen a switch from cables being mostly funded by telecommunication carriers to being funded by content providers, like Google and Facebook. Members of the private cable industry say content companies can afford to invest in cable infrastructure to ensure the supply chain for their customers, but that the competition puts the squeeze on the research-and-development budgets of other types of companies.

Sloots at Southern Cross predicted that the nations which connected directly to the massive next-generation cable – Samoa, Kiribati and Tokelau – would be able to function as connecting points for intra-Pacific cables.

“There’s a blossoming effect in capability once certain islands are connected,” Sloots said.

There is also the push to locate an exchange point within the Pacific so that internet data no longer has to travel to a hub in Tokyo or Los Angeles and back to Pacific nations when processing – a move that could ultimately lower the cost of broadband internet service for consumers in the Pacific.

Perhaps the most effective outcome could be for Pacific nations to cut the cord and receive their internet by satellite.

The Asian Development Bank has agreed to give a US$50 million loan to Singapore’s Kacific Broadband Satellites International to provide up to two billion people across the Asia-Pacific region with affordable satellite-based internet.

The project is to be launched into orbit by SpaceX next week and aims to begin providing service by early next year.

Source: SCMP