- ‘I felt excited and proud of myself,’ says restaurant owner and former volunteer ambulance driver Xiang Yafei

- ‘I didn’t feel afraid at all. In my mind, it’s already a successful vaccine,’ he says

Why did you apply to be a vaccine trial volunteer?

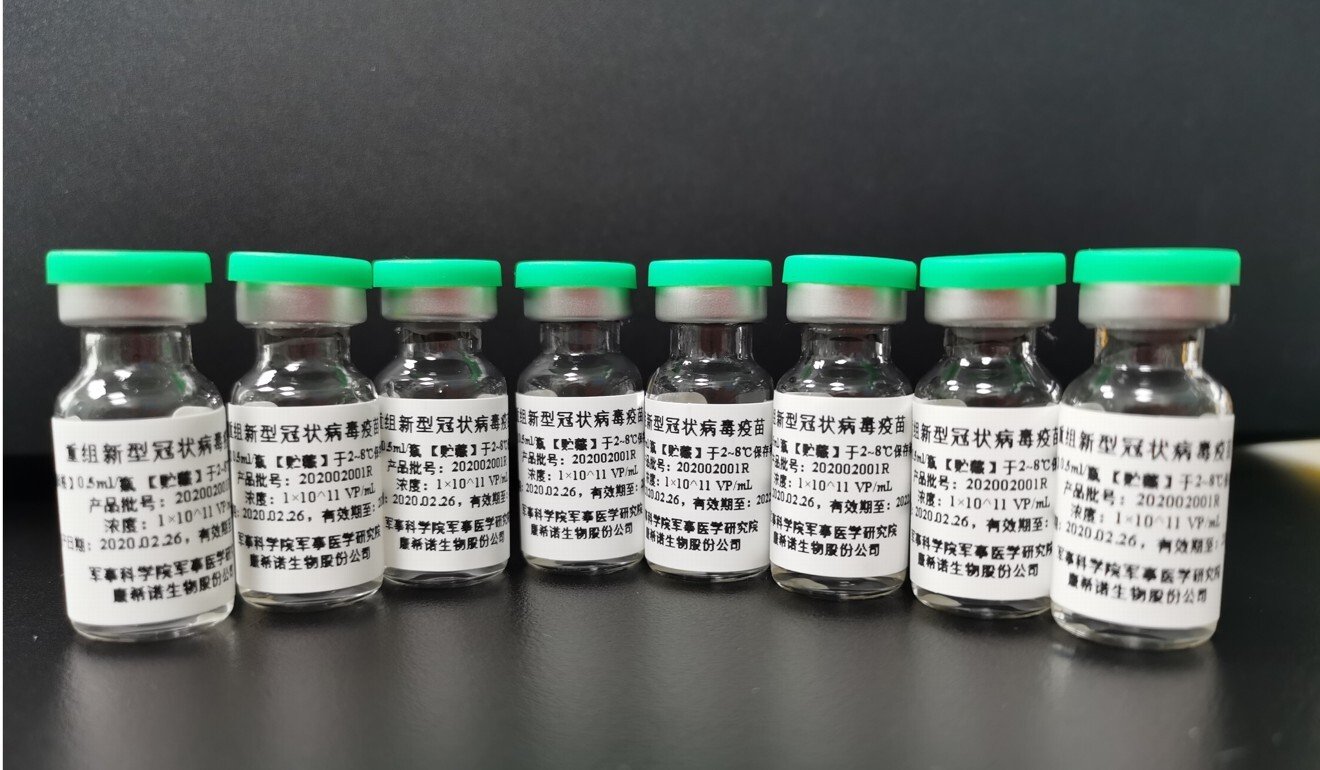

I went to the research team’s office on March 16 and filed my application – that was before they officially announced they were recruiting volunteers on the internet. While I was at the office, I was lucky to meet Major General Chen Wei, the team leader, who explained about the development of the vaccine and assured me that it wouldn’t damage my body. That boosted my confidence.

China ‘leads world in coronavirus research’, followed by US

When did you receive your injection and how did you feel at that time?

I was given mine on the morning of March 19 and immediately put into quarantine for 14 days at a PLA facility. My number in the volunteer group is 006, meaning I was the sixth person to get the vaccine. Before the injection, I underwent a strict physical check-up. I later learned that more than 5,200 people had applied to be volunteers.

Receiving the vaccine was no different to any other injection I’d had before in my life. I didn’t feel any pain and it only lasted about 10 seconds.

But in my heart, I felt excited and proud of myself. I understand that the vaccine will be an important part in battling this coronavirus and testing it is part of the preparations before it can be put on the market.

They didn’t show any bad symptoms, so at that moment, I didn’t feel afraid at all. In my mind, it’s already a successful vaccine.

And how has your health been since receiving the vaccine?

I had a fever, 37.6 degrees, for the first two days. It was like catching a normal cold, with symptoms of fatigue and drowsiness. But from the third day, my condition improved and I was basically in good health.

The 108 volunteers are divided into three streams, with each receiving either a low, medium or high dose of the drug. I was in the low group so only got one dose. Volunteers in the medium group also got one and the high group were given two shots. As far as I know, everyone was fine after receiving their injections.

When will your trial result be available?

After my quarantine period ended on April 2, I was given a CAT scan and the researchers took a sample of my blood for testing. They said it would be two weeks before they could tell if there were coronavirus antibodies in my bloodstream.

I am not sure if they will tell me the result, but over the next five months I have to do four more blood tests to see if I have antibodies and how long they might remain in my blood.

What did you do to keep yourself entertained during the quarantine period?

It was just rest for me. Before then I’d been a volunteer ambulance driver in Wuhan, working every day taking coronavirus patients to hospital. I’d been really busy for more than a month, so the 14-day quarantine period gave me a chance to relax and catch up on some sleep.

I really enjoyed my time there thanks to the meals I was given, which were nutritious and varied.

The volunteers had to stay in their rooms and we were not allowed to visit each other. We were also told to check our temperature every day and to report any symptoms. I read books and exercised in my room. Some of the volunteers practised calligraphy, some played football with their toilet paper rolls, some jogged, some composed songs, and some made videos about their life in quarantine and uploaded the clips to social media. We did everything just in our own rooms.

So what was it like working as an ambulance driver?

It was a race against time trying to get people to hospital as quickly as I could. But I felt a real sense of purpose.

At first, I didn’t want to do such work. I was scared because all the patients had been confirmed or were suspected of being infected, and they were contagious.

I was told that no one wanted to be an ambulance driver, but I had a licence to drive a minivan so I decided to do it. I think we young people should make a contribution to society, especially during this difficult time and in our home city and home province, so I applied.

Also, [each day at work] I took a gourd with me. It is called hulu in Mandarin and has auspicious implications in Chinese, as hu sounds similar to fu, which means good luck.

How was your restaurant business affected by the epidemic?

I lost about half a million yuan (US$70,000) because of it. I decided to shut my restaurant down on January 21, two days before the official lockdown, because there had been rumours it was coming and I wanted my workers to be able to leave Wuhan and return to their hometowns.

Right now I’m making preparations to reopen my restaurant, which means a lot of cleaning and disinfecting, and thinking about serving all my customers again.

So how did you feel when the lockdown was lifted on Wednesday?

The situation in Wuhan is getting better. We are proud of what we did for this city. We hope the coronavirus cases can drop to zero soon and our lives can get back to normal.

Source: SCMP