25/04/2020

- But trade with partner countries might not be as badly affected as with countries elsewhere in the world, observers say

- China’s trade with belt and road countries rose by 3.2 per cent in the January-March period, but second-quarter results will depend on how well they manage to contain the pathogen, academic says

China’s investment in foreign infrastructure as part of its Belt and Road Initiative has been curtailed because of the coronavirus pandemic. Photo: Xinhua

The

coronavirus pandemic is set to cause a slump in Chinese investment in its signature

and a dip in trade with partner countries that could take a year to overcome, analysts say.

But the impact of the health crisis on China’s economic relations with nations involved in the ambitious infrastructure development programme might not be as great as on those that are not.

China’s total foreign trade in the first quarter of 2020 fell by 6.4 per cent year on year, according to official figures from Beijing.

Trade with the United States, Europe and Japan all dropped in the period, by 18.3, 10.4 and 8.1 per cent, respectively, the commerce ministry said.

By comparison, China’s trade with belt and road countries increased by 3.2 per cent in the first quarter, although the growth figure was lower than the 10.8 per cent reported for the whole of 2019.

China’s trade with 56 belt and road countries – located across Africa, Asia,

Europe and South America – accounts for about 30 per cent of its total annual volume, according to the commerce ministry.

Despite the first-quarter growth, Tong Jiadong, a professor of international trade at Nankai University in Tianjin, said he expected China’s trade with belt and road countries to fall by between 2 and 5 per cent this year.

His predictions are less gloomy than the 13 to 32 per cent contraction in global trade forecast for this year by the

World Trade Organisation.

“A drop in [China’s total] first-quarter trade was inevitable but it slowly started to recover as it resumed production, especially with Southeast Asian, Eastern European and Arab countries,” Tong said.

“The second quarter will really depend on how the epidemic is contained in belt and road countries.”

Nick Marro, Hong Kong-based head of global trade at the Economist Intelligence Unit, said he expected China’s total overseas direct investment to fall by about 30 per cent this year, which would be bad news for the belt and road plan.

“This will derive from a combination of growing domestic stress in China, enhanced regulatory scrutiny over Chinese investment in major international markets, and weakened global economic prospects that will naturally depress investment demand,” he said.

The development of the Chinese built and operated special economic zone in the Cambodian town of Sihanoukville is reported to have slowed, while infrastructure projects in Bangladesh, including the Payra coal-fired power plant, have been put on hold.

The development of the Chinese built and operated special economic zone in the Cambodian town of Sihanoukville is reported to have slowed. Photo: AFP

Marro said the reduction of capital and labour from China might complicate other projects for key belt and road partner, like Pakistan, which is home to infrastructure projects worth tens of billions of US dollars, and funded and built in large part by China.

“Pakistan looks concerning, particularly in terms of how we’ve assessed its sovereign and currency risk,” Marro said.

“Public debt is high compared to other emerging markets, while the coronavirus will push the budget deficit to expand to 10 per cent of GDP [gross domestic product] this year.”

Last week, Pakistan asked China for a 10-year extension to the repayment period on US$30 billion worth of loans used to fund the development of infrastructure projects, according to a report by local newspaper Dawn.

China’s overseas investment has been falling steadily from its peak in 2016, mostly as a result of Beijing’s curbs on capital outflows.

Last year, the direct investment by Chinese companies and organisations other than banks in belt and road countries fell 3.8 per cent from 2018 to US$15 billion, with most of the money going to South and Southeast Asian countries, including Singapore, Vietnam, Indonesia and Pakistan.

Tong said the pandemic had made Chinese investors nervous about putting their money in countries where disease control measures were becoming increasingly stringent, but added that the pause in activity would give all parties time to regroup.

“Investment in the second quarter will decline and allow time for the questions to be answered,” he said.

“Past experience along the belt and road has taught many lessons to both China and its partners, and forced them to think calmly about their own interests. The epidemic provides both parties with a good time for this.”

Dr Frans-Paul van der Putten, a senior research fellow at Clingendael Institute in the Netherlands, said China’s post-pandemic strategy for the

belt and road in Europe

might include a shift away from investing in high-profile infrastructure projects like ports and airports.

Investors might instead cooperate with transport and logistics providers rather than invest directly, he said.

“Even though in the coming years the amount of money China loans and invests abroad may be lower than in the peak years around 2015-16, I expect it to maintain the belt and road plan as its overall strategic framework for its foreign economic relations,” he said.

Source: SCMP

Posted in 10-year, 2018, 2019, 2020, 30, academic, according, accounts, across, activity, africa, airports, allow, ambitious, analysts, annual volume, answered, Arab countries, Asia, bad news, Bangladesh, because, Beijing, Belt and Road Initiative, belt and road plan, billion, billions, budget deficit, Cambodian, capital, capital outflows, cause, China, China’s, Chinese, Clingendael Institute, combination, Commerce Ministry, compared, comparison, complicate, contained, contraction, cooperate, coronavirus, Coronavirus pandemic, countries, curbs, Currency, curtailed, Dawn, decline, demand, depend, depress, derive, development, dip, direct investment, disease control measures, domestic stress, dropped, Eastern European, economic prospects, economic relations, Economist Intelligence Unit, elsewhere, Emerging markets, enhanced, epidemic, especially, Europe, extension, fall, falling, Fell, figure, first-quarter, forecast, foreign, foreign trade, GDP [gross domestic product], global trade, gloomy, great, growth, health crisis, high, impact, increased, increasingly, Indonesia, inevitable, Infrastructure, infrastructure projects, international markets, International trade, Investment, investors, involved, January, Japan, Labour, last week, loans, local newspaper, located, logistics, lower, Major, manage, March, might not, nations, naturally, nervous, Netherlands, observers, official figures, on hold, other, overall strategic framework, overcome, overseas, Pakistan, pandemic, parties, partner, pathogen, pause, Payra coal-fired power plant,, per cent, Period, ports, predictions, production, professor, programme, providers, Public debt, put, questions, recover, reduction, regroup, regulatory scrutiny, repayment, reported, results, resumed, Risk, second-quarter, signature, Singapore, slowed, slower, slump, South, South America, Southeast Asian, sovereign, special economic zone, stringent, take, this year, Tianjin, time, Total, town, Trade, Transport, Uncategorized, United States, US dollars, US$30, Vietnam, weakened, while, World, world trade organisation, worth, year, year-on-year |

Leave a Comment »

13/04/2020

- China’s famed Yiwu International Trade Market, a barometer for the health of the nation’s exports, has been hammered by the economic fallout from Covid-19

- Export orders have dried up amid sweeping containment measures in the US and Europe and restrictions on foreigners entering China have shut out international buyers

The coronavirus pandemic has severely dented wholesale trade at the Yiwu International Trade Market in China. Photo: SCMP

The Yiwu International Trade Market has always been renowned as a window into the vitality of Chinese manufacturing, crammed with stalls showcasing everything from flashlights to machine parts.

But today, as the coronavirus pandemic rips through the global economy, it offers a strikingly different picture – the dismal effect Covid-19 is having on the nation’s exports.

The usually bustling wholesale market, home to some 70,000 vendors supplying 1,700 different types of manufactured goods, is a shadow of its former self.

Only a handful of foreign buyers traipse through aisles of the sprawling 4-million-square-metre (43 million square feet) complex, while store owners – with no customers to tend to – sit hunched over their phones or talking in small groups.

A foreign buyer visits a stall selling face masks. Photo: Ren Wei

“We try to convince ourselves that the deep slump will not last long,” said the owner of Wetell Razor, Tong Ciying, at her empty store. “We cannot let complacency creep in, although the coronavirus has sharply hampered exports of Chinese products.”

Chinese exports plunged by 17.2 per cent in January and February combined compared to the same period a year earlier, according to the General Administration of Customs. The figure was a sharp drop from 7.9 per cent growth in December.

After riding out a supply shock that shut down most of its factories, China is now facing a

second wave demand shock, as overseas export orders vanish amid sweeping containment measures to contain the outbreak around the globe.

Nowhere is that clearer to see than in Yiwu. The city of 1.2 million, which lies in the prosperous coastal province of Zhejiang, was catapulted into the international limelight as a showroom for Chinese manufacturing when the country joined the World Trade Organisation in 2001.

Coronavirus: Is the gig economy dead, and should the self-employed worry?

Before the pandemic, thousands of foreign buyers would flock to the mammoth trade market each day to source all manner of products before sending them home.

But the outbreak, which has claimed the lives of more than 113,000 people and infected more than 1.9 million around the world, is proving a major test for the market and the health of the trade dependent city.

Imports and exports via Yiwu last year were valued at 296.7 billion yuan (US$42.2 billion) – nearly double the city’s economic output.

Businesses, however, are facing a very different picture in 2020. Most traders at the market say they have lost at least half their business amid the pandemic, which was first detected in the central Chinese city of Wuhan last year.

Just take a look at the situation in Yiwu and you will understand the extent of the virus’ effect on China’s trade with foreign countries – Tianqing

“Yiwu is the barometer for China’s exports,” said Jiang Tianqing, the owner of Beauty Shine Industry, a manufacturer of hair brushes. “Just take a look at the situation in Yiwu and you will understand the extent of the virus’ effect on China’s trade with foreign countries.”

Jiang said his business was only just hanging on thanks to a handful of loyal customers placing orders via WeChat.

“I assume it will be a drawn-out battle against the coronavirus,” he said. “We are aware of the fact that developed economies like the US and Europe have been severely affected.”

The Yiwu market reopened on February 18 after a one-month long hiatus following the Lunar New Year holiday and the government’s order to halt commercial activities to contain the spread of the outbreak.

Jiang Tianqing, owner of hair brush company Beauty Shine Industry. Photo: Ren Wei

But facing the threat of a spike in imported cases, Beijing banned foreigners from entering the country in late March – shutting out potential overseas buyers.

Despite the lack of business, local authorities have urged stall owners to keep their spaces open to display Yiwu’s pro-business attitude, owners said.

“For those bosses who just set up their shops here, it would be a do-or-die moment now since their revenue over the next few months will probably be zero,” said Tong. “I am lucky that my old customers are still making orders for my razors.”

The impact of the coronavirus is just the latest challenge for local merchants, who normally pay 200,000 yuan (US$28,000) per year for a 10-square-metre (108 square feet) stall at the market.

Traders were hard hit by the

trade war between China and the United States when the Trump administration imposed a 25 per cent tariff on US$200 billion of Chinese imports last year.

At the time, some Chinese companies agreed to slash their prices to help American buyers digest the additional costs.

“But it is different this time,” said Jiang. “Pricing does not matter. Both buyers and sellers are eager to seal deals, but we are not able to overcome the barriers [to demand caused by the virus].”

Even when businesses can secure orders, it is a struggle to deliver them

Ma Jun, a manager with a LED light bulb trading company, said the only export destination for her company’s products was war-torn Yemen because it was the only country with ports still open.

It is a public health crisis that ravages not just our businesses, but the whole world economy – Dong Xin

Dong Xin, an entrepreneur selling stationery products, said he could not ship the few orders he had because “ocean carriers have stopped operations”.

“It is a public health crisis that ravages not just our businesses, but the whole world economy,” he said. “The only thing can do is to pray for an early end to the pandemic.”

Most wholesale traders in the Yiwu market run manufacturing businesses based outside the city, so a sharp fall in sales has a ripple effect on their factories, potentially resulting in massive job cuts.

Workers pack containers at Yiwu Port, an inland port home to dozens of warehouses. Photo: Ren Wei

At Yiwu Port, an inland logistics hub full of warehouses where goods from the factories are unpacked and repacked for shipping abroad, container truck drivers joke about their job prospects.

“We used to commute between Shaoxing and here five times a week, and now it is down to twice a week,” said a driver surnamed Wang, describing the trip from his home to the shipping port, just over 100km away.

“At the end of the day, we may not be infected with the coronavirus, but our jobs will still be part of the cost of the fight against it.”

Source: SCMP

Posted in 2001, 25, abroad, aisles, banned, barometer, Beauty Shine Industry, Beijing, businesses, Buyers, catapulted, China, China’s, Chinese manufacturing, commute, complex, containers, containment, coronavirus, Coronavirus pandemic, Country, COVID-19, crammed, different picture, Dozens, dried up, economic fallout, entering, Entrepreneur, Europe, everything, export, export orders, face masks, factories, famed, February, flashlights, Foreigners, global, global economy, goods, grinds, hair brush company, halt, health, Home, imposed, infected, inland, international, International Trade Market, January, job cuts, jobs, joke, LED light bulb, limelight, logistics hub, Lunar New Year holiday, machine parts, mammoth, Manufacturing, March, massive, measures, ocean carriers, orders, outbreak, overseas, pack, pandemic, per cent, phones, Port, public health crisis, ravages, repacked, second wave, selling, Shaoxing, ship, shipping, shipping port, showcasing, Showroom, Stalls, stationery products, store owners, strikingly, sweeping, Tariff, trade war, traders, trading company, traipse, truck drivers, Trump administration, Uncategorized, United States, unpacked, vanish, vendors, warehouses, WeChat, whole, wholesale, workers, world economy., world trade organisation, Wuhan, Yemen, Yiwu Port, Zhejiang |

Leave a Comment »

06/03/2019

- Issue a key demand made by US President Donald Trump as part of the ongoing US-China trade war

- China expected to pass new foreign investment law next week during National People’s Congress

Foreign direct investment in China amounted to US$135 billion in 2018, an increase of 3 per cent from a year earlier, according to Chinese government data. Photo: EPA

Beijing will make it illegal to force foreign investors to transfer their technology to Chinese partners while also lowering market barriers for foreign firms to enter the domestic market, a senior economic planning official said on Wednesday, highlighting an effort to lure overseas investment inflows.

China is expected to pass a new law next week intended to protect the interests of foreign investors, both as a response to demands from the United States that have formed part of the ongoing trade war negotiations, and to help shore up economic growth, which slowed last year to its lowest rate in 28 years.

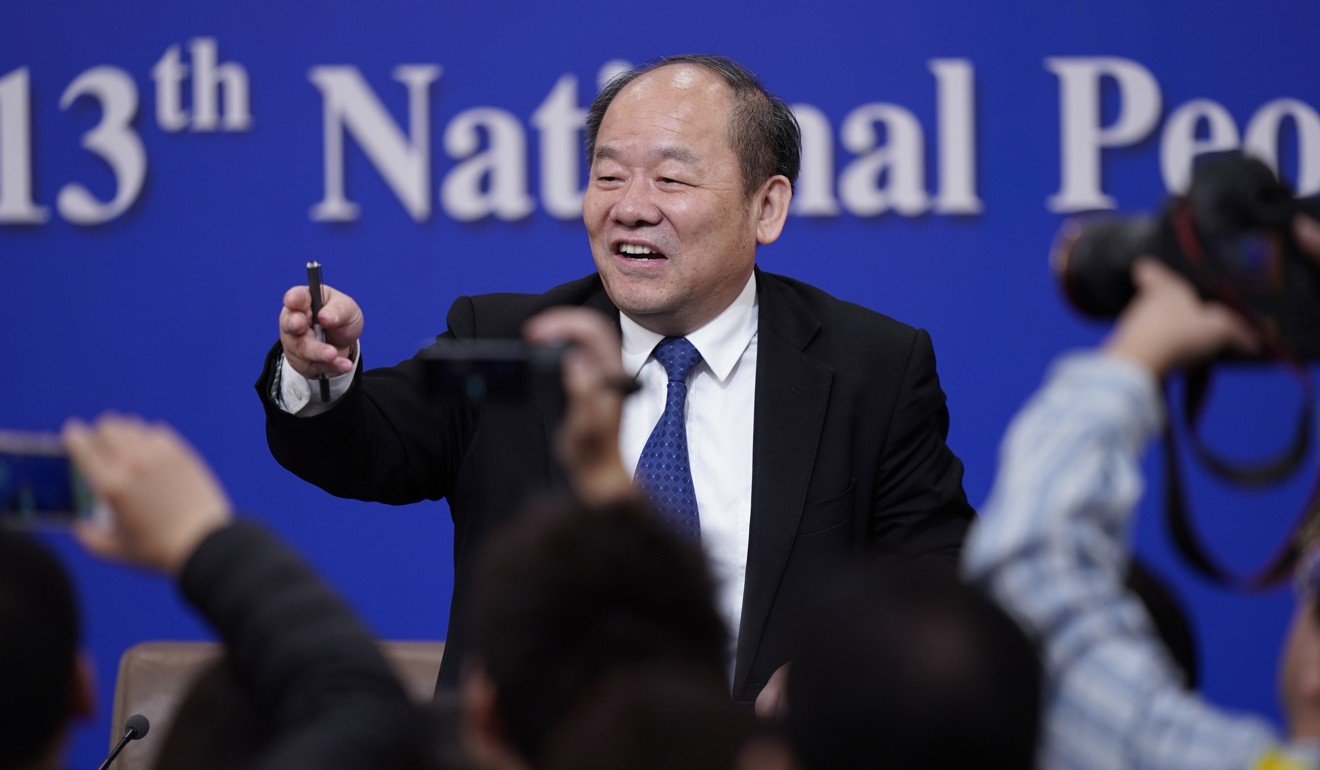

Foreign investors will be allowed to set up ventures in which they have full ownership, instead of being forced into joint ventures with local partners, in more industries, said Ning Jizhe, a vice-chairman of the National Development and Reform Commission, in Beijing on Wednesday during the National People’s Congress.

In addition, China will set up a special task force to facilitate “key” projects like electric-car maker Tesla’s new factory in Shanghai or BASF’s new chemical complex in Guangdong, both of which are solely owned by the foreign company.

China’s leadership has listed foreign investment as one of the six areas that it must “stabilise” in 2019, along with employment, growth, trade, domestic investment and market expectations.

Foreign direct investment in China amounted to US$135 billion in 2018, an increase of 3 per cent from a year earlier, according to Chinese government data.

But foreign investment into the world’s second biggest economy have slowed over last decade, which could deprive China of access to advanced technologies and marginalise the country in the development of future global supply chains.

Beijing is trying to lure more foreign capital and technology to support its plan to upgrade its manufacturing industries and boost the development of new, hi-tech sectors.

“China will roll out more opening-up measures in the agriculture, mining, manufacturing and service sectors, allowing wholly foreign-owned enterprises in more fields,” Ning said.

China law to protect intellectual property, ban forced tech transfer

Since December, China has been rushing to draft legislation for a new foreign investment law, a key clause of which prohibits local government’s from forcing transfer of technology in return for being allowed to conduct business in their jurisdictions.

The National People’s Congress is expected to endorse the new

“After passing the law, the government will take serious measures to obey and implement it,” Ning added.

He said that China will remove market entry restrictions for foreign investors to ensure that domestic and foreign firms “are treated as equals.”

Ning Jizhe, a vice-chairman of the National Development and Reform Commission. Photo: EPA

However, the jury is still out whether Beijing’s promises of fair treatment, market access and protection for intellectual property rights will be enough to generate a steady inflow of hi-tech investment.

The US has long complained that China has been unwilling to implement previous commitments under the World Trade Organisation to open up its market – allegation Beijing denies.

Shen Jianguang, chief economist at JD Digits, an arm of Chinese e-commerce firm JD.com, said restrictions on foreign investment will exist in China despite the government’s promises.

China’s domestic market remains large and attractive for some foreign investors, he said.

“Foreign investors are still very interested in the Chinese market, if the openness of the economy is sufficient,” Shen added.

Source: SCMP

Posted in agriculture, BASF, chemical complex, Chief economist, domestic market, E-commerce, forced technology transfer, foreign investors, Guangdong, illegal, JD Digits, JD.com, Manufacturing, market barriers, mining, National People’s Congress, Ning Jizhe, President Donald Trump, service sectors, Shanghai, Shen Jianguang, Tesla, Uncategorized, US-China trade war, vice-chairman of the National Development and Reform Commission, world trade organisation |

Leave a Comment »