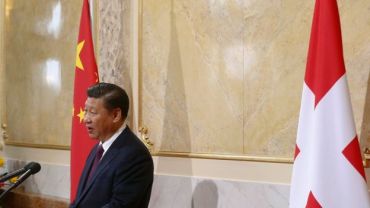

China’s President Xi Jinping heads to Davos this week.

It’s the first time a Chinese head of state is attending the global forum and he’ll be star of the show.

But besides the allure of snow-capped alpine peaks and tasty cups of hot chocolate, why is he doing this? And why now?

First off, let’s not kid ourselves. Davos is a venue where little meaningful gets done.

It has struggled to shake its reputation as a very expensive talking shop that sees the rich and powerful of global business, politics, arts and society meet every year to sip cocktails and connect.

Along the way they’re supposed to think big thoughts about how to improve the world economy.

But given that their wealth and lifestyles are precisely what many parts of the developed world is seeing a backlash against right now, it’s not clear how much their solutions will help.

Davos: Are the global elite in retreat?

Globalisation and free trade are being attacked in the US and Europe. And with a new president about to enter the White House, President Xi’s speech will be watched very carefully.

According to Jiang Jianguo, a minister in China’s State Council Information office, President Xi will be “offering Chinese remedies for the world’s economic ailments”.

So what might he say, and why is this important? Here are three things I’ll be watching for:

1) Free trade is good trade

Globalisation has arguably benefited China more than any other country in the world.As the US pulls out of free trade agreements, President Xi is likely to laud its merits, and position China as the world’s newest and friendliest trading partner.

Of course, there’s always the criticism that China only opens up its economy just enough to benefit itself.But President Xi is likely to tackle that too. Chinese leaders tend to make big announcements in speeches abroad, so watch out for any further possible access to China’s economy.

2) China as a force for peace, not war

China’s growing military might in the South China Sea is a potential flashpoint

It’s part of China’s public diplomacy to convince the world that China’s rise is a good thing for everyone.

President Xi will be likely to present an image of China to the world “as a friend to everyone, a big wonderful panda that everyone should hug, and that everyone should just relax,” says Prof Kerry Brown of the Lau China Institute at King’s College London.

But this may be a hard sell, especially given the lingering concerns about China’s growing military might in the South China Sea.

Davos is a good opportunity to challenge these perceptions, says Jia Xiudong, at the China Institute of International Affairs in Beijing.

“Other countries may see China as an aggressive, assertive country. But this is a misunderstanding. That’s why it’s such a good opportunity for the president to communicate his message.

“Oh, and that no-one will be unfurling Free Tibet flags or heckling him (at least not inside the venue) will probably be an added benefit.

3) It’s all about symbolism, silly

President Xi’s speech comes just three days before Donald Trump is inaugurated as the 45th president of the United States.

“America is downgraded slightly in the eyes of the world because of the election,” says Prof Brown. “And China is more prominent – so it’s quite significant.”

Vanity is also a factor. President Xi enjoys massive popularity at home, and, as you might expect, would like to see that level of respect paid to him on the international stage.

What better way to do that than to praise the virtues of China’s economic wisdom to a receptive crowd, at a time when faith in the US’s ability as the de facto superpower is being questioned and dissatisfaction for the free market system – and the inequality it has created – is rising.

But while President Xi may enjoy being thrust into the spotlight on the Davos stage, it won’t erase some of the hard truths he has to deal with back home.

China’s economy is slowing down and its currency, the yuan, is weakening to lows not seen since 2008.

All of this has Beijing extremely concerned. China knows better than most that a growing gap between the haves and the have nots is devastating for social stability.

Source: Davos 2017: Can Xi Jinping be star of the show? – BBC News

In a first of its kind global rankings, across different groups of countries in terms of their per capita income levels, the

In a first of its kind global rankings, across different groups of countries in terms of their per capita income levels, the