China’s largest oil fields are the stuff of Communist Party folklore, but today they’re potent symbols of the challenges facing China’s energy industry.

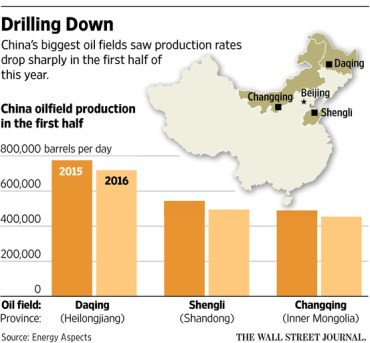

Significant falls in the first half of this year at China’s biggest-producing oil fields — Daqing, Shengli, and Changqing — have solidified a moment anticipated by the global energy industry: Oil production in China is in long-term decline.

The turnabout is jarring for an industry that has long held huge political sway in China. The “Daqing Spirit”– meaning hard work in the face of challenges — has long been celebrated by top leaders. The companies have been held up as critical to fueling China’s economic rise.

The London-based consultancy Energy Aspects compiled data from China’s oil fields. It shows just how great a toll the plunge in crude prices has taken on overall domestic production.

China’s three biggest oil fields experienced production declines of between 7-9% in the first half, according to Energy Aspects. That far outpaced China’s production decline as a whole. Small gains from output in the Xinjiang region and elsewhere haven’t been enough to compensate.

The declines are important, Energy Aspects said in a recent report, “because it symbolizes a significant shift in thinking” by Chinese officials. While the government has a long-held goal of limiting imports — and protecting jobs in places like Daqing — by keeping production high, leaders seem to have realized that track was both unsustainable and expensive.

With global crude prices under $50 per barrel, many aging wells at big oil fields in China lose money with each barrel they pump. Shutting off the taps at home helps to stem losses when cheaper oil can be purchased from overseas.

So what does it mean?In short, the assets that long served as the cornerstone for revenue for companies such as PetroChina are drying up. If China’s energy giants want to be more profitable–as outside investors and China’s government are pressuring them to do–they’re going to need to look to diversify revenue.

That’s likely to include a mix of initiatives, say Chinese executives and analysts. One part of the drive might be trying to secure new oil production overseas. That would mean a renewed push for outbound deals. Big discoveries in Brazil and elsewhere appear particularly attractive to China.

The other path to future growth is more complicated. For example, China’s oil companies are keen to learn how to boost sales and profits at the thousands of retail gas stations across China. Earning more money from sales of Snickers bars or cigarettes would make them somewhat less vulnerable to the vicissitudes of global oil prices.

The bottom line: China’s oil industry, like the economy as a whole, is destined for big changes. Many of those in the coming years will involve a greater global role for the oil giants — PetroChina, Sinopec, and Cnooc — than they currently have today.

The bigger global footprint is inevitable, says one person with ties to China’s top oil executives, as production at home begins to dwindle. The international revenues are needed to stave off a domestic slowdown.

“We are coming. We are coming,” he said.

Source: China’s Oil Industry Destined for Big Changes – China Real Time Report – WSJ