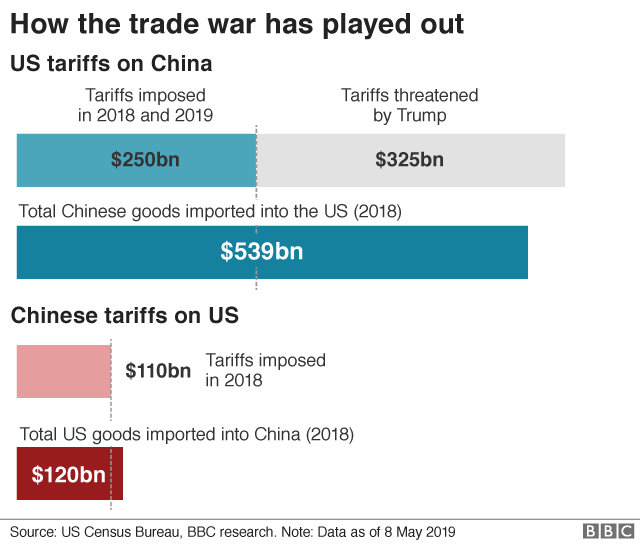

The US has more than doubled tariffs on $200bn (£153.7bn) worth of Chinese products, in a sharp escalation of the countries’ damaging trade war.

Tariffs on affected Chinese goods have risen to 25% from 10%, and Beijing has vowed to retaliate.

China says it “deeply regrets” the move and will have to take “necessary counter-measures.”

It comes as high-level officials from both sides are attempting to salvage a trade deal in Washington.

Only recently, the US and China appeared to be close to ending months of trade tensions.

China’s Commerce Ministry confirmed the latest US tariff increase on its website.

“It is hoped that the US and the Chinese sides will work together… to resolve existing problems through co-operation and consultation,” it said in a statement.

Tariffs are taxes paid by importers on foreign goods, so the 25% tariff will be paid by American companies who bring Chinese goods into the country.

Chinese stock markets rose on Friday, with the Hang Seng index up less than 1% and the Shanghai Composite more than 3% higher.

However, earlier in the week stock markets had fallen after US President Donald Trump flagged the tariff rise on Sunday.

The US imposed a 10% tariff on $200bn worth of Chinese products – including fish, handbags, clothing and footwear – last year.

The tariff was due to rise at the start of the year, but the increase was delayed as negotiations advanced.

What will be the impact of the tariff rise?

The US-China trade war has weighed on the global economy over the past year and created uncertainty for businesses and consumers.

Even though Mr Trump has downplayed the impact of tariffs on the US economy, the rise is likely to affect some American companies and consumers as firms may pass on some of the cost, analysts said.

Deborah Elms, executive director at the Asian Trade Centre, said: “It’s going to be a big shock to the economy.

“Those are all US companies who are suddenly facing a 25% increase in cost, and then you have to remember that the Chinese are going to retaliate.”

Image copyright GETTY IMAGES

Image copyright GETTY IMAGESIn a statement, the American Chamber of Commerce in China said it was committed to helping both sides find a “sustainable” solution.

“While we are disappointed that the stakes have been raised, we nevertheless support the ongoing effort by both sides to reach agreement on a strong, enforceable deal that resolves the fundamental, structural issues our members have long faced in China.”

French Finance Minister Bruno Le Maire warned that the trade dispute escalation threatened jobs across Europe.

“There is no greater threat to world growth,” Mr Le Maire told CNews. “It would mean that trade tariffs go up, fewer goods would circulate around the world… and jobs in France and in Europe would be destroyed.”

‘Serious escalation’ of the trade war

No breakthrough, and no deal – just, more tariffs.

With this move, US President Donald Trump has effectively dealt a fresh blow to not just the Chinese economy – as he had presumably hoped – but also to US’s.

The previous set of tariffs of 10% on $200bn of Chinese goods have to some extent been absorbed by American importers, but economists say a 25% tariff will be much harder for them to stomach.

They will almost certainly have to pass on that cost to American consumers – and that means higher prices.

Make no mistake, this is a serious escalation – and the trade war between the world’s two largest economies is back on.

This means the rest of us should be prepared for more pain ahead.

How will the tariff increase affect negotiations?

Despite this week’s escalation in tensions, talks were held between Chinese Vice-Premier Liu He, US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin on Thursday.

A White House spokesman said US officials had agreed with the vice-premier to resume talks on Friday morning, according to media reports.

Even though there had been growing optimism about progress in trade talks recently, sticking points have persisted throughout.

These have included issues around intellectual property protection, how fast to roll back tariffs and how to enforce a deal.

Analysts say the Chinese are still willing to negotiate to retain the moral high ground and because they recognise the importance of solving the trade war.

“A trade war will be bad for China, both the real economy and the financial markets. It will also be bad for the world economy,” said Gary Hufbauer of the Peterson Institute for International Economics.

“Better for China to play the role of conciliatory statesman than angry retaliator.”

Why are the US and China at odds?

China has been a frequent target of Donald Trump’s anger, with the US president criticising trade imbalances between the two countries and Chinese intellectual property rules, which he says hobble US companies.

Some in China see the trade war as part of an attempt by the US to curb its rise, with Western governments increasingly nervous about China’s growing influence in the world.

Both sides have already imposed tariffs on billions of dollars worth of one another’s goods. The situation could become worse still, as Mr Trump has also warned he could “shortly” introduce 25% duties on $325bn of Chinese goods.

What exactly sparked the US president’s latest actions, which apparently took China by surprise, is unclear.

Ahead of the discussions, Mr Trump told a rally China “broke the deal” and would pay for it.

The International Monetary Fund said the row poses a “threat to the global economy”.

“As we have said before, everybody loses in a protracted trade conflict,” the body which aims to ensure global financial stability said in a statement, calling for a “speedy resolution”.

Source: The BBC