23/04/2020

- Test in Xiong’an, the new city being built south of Beijing, will focus on everyday goods and services for the first time

- American food outlets to be included in the digital currency tests, conducting small transactions with local firms

American chains Starbucks, McDonald’s and Subway were named on the People’s Bank of China’s list of firms that will test the digital currency in small transactions with 19 local businesses. Photo: Bloomberg

China’s central bank has accelerated the testing of its new sovereign digital currency and, for the first time, will include some foreign consumer brands in the programme.

American chains Starbucks, McDonald’s and Subway were named on the People’s Bank of China (PBOC)’s list of firms that will test the

digital currency in small transactions with 19 local businesses.

The global names will be joined by local hotels, convenience stores, a stuffed bun shop, a bakery, a bookstore and a gym, according to details revealed at a promotional event in the Xiong’an New Area, a city being built south of Beijing, news portal Sina.com reported.

The inclusion of businesses providing everyday goods and services marks an expansion of the PBOC’s testing. It follows a previous disclosure that last week in Suzhou the digital currency was used to pay half public sector workers’ travel subsidies for May.

Is China a currency manipulator?

Wednesday’s promotional event was organised by the local branch of the National Development and Reform Commission, the powerful planning agency, and attended by representatives of the Big Four state-owned banks and two of the country’s internet giants – Alibaba and Tencent.

China has not released a timetable for launching the digital yuan, but last week’s reports on new testing have fanned speculation that it could be imminent.

The tests were reportedly accelerated after Facebook launched its Libra project in June last year, an attempt to create a

global digital currency pegged to a basket of currencies and backed by global commercial giants.

The Libra Association, the consortium managing the project, announced changes last week in an attempt to win regulatory approval and pave the way for an official launch sometime later this year. The consortium said it would create multiple digital units tied to existing currencies such as the US dollar or the euro, rather than a single token based on a basket of currencies.

China’s official digital currency, known as Digital Currency Electronic Payment (DCEP), came into the public spotlight last week

when a screenshot of a test version of an app developed by the Agricultural Bank of China circulated online.

The digital currency app has several basic functions, similarly to other Chinese online payment platforms such as Alipay and WeChat Pay – the country’s two most popular online payment tools – allowing users to make and receive payments, and transfer money.

“It’s certain that the DCEP is now in its final testing stage and should be officially launched,” BlockVC, an investment firm, said in a research note.

The PBOC’s digital currency research institute confirmed last Friday that testing was being conducted in four cities: Shenzhen, Suzhou, Xiong’an and Chengdu. In addition, venues for the 2022 Winter Olympics in Beijing and Zhangjiakou will join the testing programme in the future.

What is the Hong Kong Dollar Peg?

The institute, which was inaugurated in 2017, said that the test versions and applications of the currency had not been finalised.

The project testing is based on two principles: the central bank issues the virtual money to commercial banks who then pass it on to consumers, and that is aimed at replacing cash in all transactions.

China is the first major economy to publicly announce plans for a sovereign digital currency, aiming to better control the rapid rise of digital payments worldwide.

The PBOC has, however, cracked down on the trading of other digital currencies and banned banks from accepting cryptocurrencies, which it views as a risk to financial stability.

Source: SCMP

Posted in 2022, accelerated, Agricultural Bank of China, Alibaba, American, among, bakery, Beijing, Big Four, bookstore, built, Chengdu, China’s, conducting, consortium, convenience stores, cryptocurrencies, digital currency, Digital Currency Electronic Payment (DCEP), everyday, Facebook, first time, focus, food outlets, Foreign firms, goods and services, Gym, included, internet giants, June, Libra, Libra Association, local firms, local hotels, May, McDonald’s, National Development and Reform Commission, New Area, new city, news portal, People’s Bank of China (PBOC)’s, People’s Bank of China’s, planning agency, public sector workers’, reported, set to, Shenzhen, Sina.com, small, South, sovereign, starbucks, stuffed bun shop, Subway, Suzhou, TENCENT, test, transactions, travel subsidies, Uncategorized, Winter Olympics, Xiongan, Zhangjiakou |

Leave a Comment »

21/04/2020

- Israeli medical equipment firm IceCure Medical, with an initial US$4 million sales and marketing effort, will open its first Chinese office in Shanghai

- English shopping outlet company Value Retail sees the chance to lure consumers who have been under lockdowns aimed at halting the spread of the coronavirus

Foreign firms, including Israeli medical equipment maker IceCure Medical and English shopping outlet company Value Retail, still see opportunities in China despite the coronavirus. Photo: AFP

Not only has the coronavirus pandemic not watered down one company’s expansion plans for China, it has given it even greater reason to push forward into the Chinese market.

Israeli company IceCure Medical is forging ahead with opening its first Chinese office in Shanghai, with plans to spend up to US$4 million for the initial sales and marketing effort for its non-surgical breast cancer treatments.

Chief executive Eyal Shamir said he has seen an uptick in Chinese interest in the company’s ProSense product, which allows the freezing of tumours outside a hospital environment, because it can free up facilities badly needed for Covid-19 patients.

The government approval of the company’s Chinese subsidiary is now only days away following a successful product console registration, according to Shamir, and it has already sold two units to the Fudan University Shanghai Cancer Centre for a clinical study.

World Health Organisation warns the ‘worst still ahead’ in coronavirus pandemic

“We are planning a full launch of the product in China for both breast cancer and breast benign tumours as well as other organs,” Shamir said.

“Post Covid-19, there will be a backlog of many surgeries and not only for breast cancer patients.”

IceCure Medical, though, is not the only foreign company eyeing expansion into China despite the risk of secondary outbreaks of coronavirus.

West of Shanghai, English shopping outlet company Value Retail is also expanding its retail space, banking on Chinese shoppers re-emerging from lockdowns to begin

After being cooped at home for weeks, people want to be outdoors to enjoy the beautiful spring weather – Value Retail

Value Retail is proceeding with plans to enlarge its Suzhou Village shopping centre from 35,000 square metres (378,000 sq ft) to over 50,000 square metres, while also increasing the number of shops from 120 to 200, which will make it the largest of the 11 venues its controls globally.

It is working closely with the Yang Cheng Lake Peninsula government on a date for construction to start, after seeing a surprising increase in retail sales at its centres in early April. The company’s Chinese subsidiary, Value Retail China, attributed the rise to an increasing number of consumers wanting to “get outside” of their homes after being isolated for several weeks.

Suzhou Village sales have increased 40 per cent each week since the start of April, the company said.

“Thanks to the positive recovery [in spending] over the past several weeks, we are going ahead with the Suzhou Village expansion,” the company said in a statement. “After being cooped at home for weeks, people want to be outdoors to enjoy the beautiful spring weather. We provide a shopping experience for guests in an outdoor environment … the motivation for such an experience after isolation is huge. [Being] outdoors is seen as a luxury now.”

In addition, customers are flocking to both its Suzhou and Shanghai Village centres as a form of domestic tourism because of the curb on overseas travel, Value Retail China said.

Despite the economic destruction that the

coronavirus pandemic has caused in China, it also is opening up expansion opportunities for entrepreneurial firms in several industries, such as e-commerce and online delivery, life sciences and infrastructure construction, said EY Asia-Pacific transaction advisory services leader Harsha Basnayake.

However, while businesses within Asia-Pacific expressed a desire for opportunistic expansions, most companies still held a pessimistic view of economic recovery that would drag on into 2021.

American companies already operating in China were even less optimistic with over 70 per cent of businesses surveyed by the American Chamber of Commerce in March saying they were reluctant about expanding in the coming year.

Although it is too early to say if retail property will rise – particularly when we are seeing new habits forming, going from shopfronts to online and how far this new behaviour will stick. China will gives us lots of lessons on this. – Harsha Basnayake

“We are expecting opportunities in real estate, particularly in commercial property and logistics, and we think industries in life sciences, some parts of health care and infrastructure will be interesting,” Basnayake said.

“Although it is too early to say if retail property will rise – particularly when we are seeing new habits forming, going from shopfronts to online and how far this new behaviour will stick. China will gives us lots of lessons on this.”

The Chinese government’s move to increase infrastructure spending to boost the economy will also benefit certain industries, such as cement production.

Despite suffering a 24 per cent drop in sales in the first quarter due to virus-related delays in construction activities, China’s largest cement manufacturer, Anhui Conch Cement, is likely to move forward with plans to expand in part due to its participation in the Belt and Road Initiative, according to analysts at S&P Global.

Though no one would be able to tell exactly what will happen when the Covid-19 uncertainties are not completely gone, signs of recovery in China have brought encouragement to us – Justin Channe

Desires to expand are also not limited to these industries, and even the hard-hit hotel industry is starting to show green shoots.

International hotel chain IHG said that the coronavirus would not derail its new Regent-branded hotel project in Chengdu, which is expected to start construction later this year.

“Though no one would be able to tell exactly what will happen when the Covid-19 uncertainties are not completely gone, signs of recovery in China have brought encouragement to us,” said Regent Hotels & Resorts managing director Justin Channe.

“While we saw business pickup across China over the past Qing Ming Festival holiday, Chengdu and its nearby destinations were among the leading ones. In the long run, we stay confident of the outlook for the China hotel industry, including the luxury segment.”

Analysing how coronavirus broke China’s historic economic growth run

Beyond the crisis, there will be ample opportunities for new merger and acquisitions (M&A) amid business restructures and failures, particularly in China, Basnayake added.

A new EY survey found 52 per cent of Asia-Pacific businesses planned on pursuing M&A in the next year.

“While the crisis is having a severe impact on M&A sentiment, there’s evidence from the survey that M&A activity intentions remain steady in the long term. There are many who recognise this is a time where valuations will be reset, and there will be stressed and distressed acquisition opportunities,” Basnayake said.

“For example, from our interviews with corporations in China, a majority said that Covid-19 has not impacted their M&A strategies, noting that the situation has not led to any cancellations or withdrawals from deals, but only in delays in closing deals.”

Source: SCMP

Posted in 2021, aimed at, American companies, analysts, Anhui Conch Cement, Asia-Pacific, Belt and Road Initiative, broke, cancellations, cement manufacturer, chance, Chengdu, China, Chinese office, closing, Company, Construction, consumers, coronavirus, Coronavirus pandemic, COVID-19, crisis, deals, delays, despite, Economic growth, English, expansion, expected, EY Asia-Pacific, failures, Foreign firms, Fudan University Shanghai Cancer Centre, good opportunity, Green shoots, halting, historic, hotel industry, hotel project, IceCure Medical, IHG, industries, International hotel chain, Israeli, lockdowns, lure, March, medical equipment, merger and acquisitions (M&A), operating, pessimistic view, Qing Ming Festival, Regent Hotels & Resorts, Regent-branded, restructures, run, secondary outbreaks, Shanghai, shopping centre, shopping outlet, some, spread, square metres, start, still seen, Suzhou Village, Uncategorized, Value Retail, Value Retail China, withdrawals, World Health Organisation, Yang Cheng Lake Peninsula |

Leave a Comment »

19/10/2019

- ‘Only when China is good, can the world get better,’ president says in congratulatory letter read out at launch of event to promote global trade

- Summit opens two weeks after South Korean giant Samsung closes its last factory in mainland China with the loss of thousands of jobs

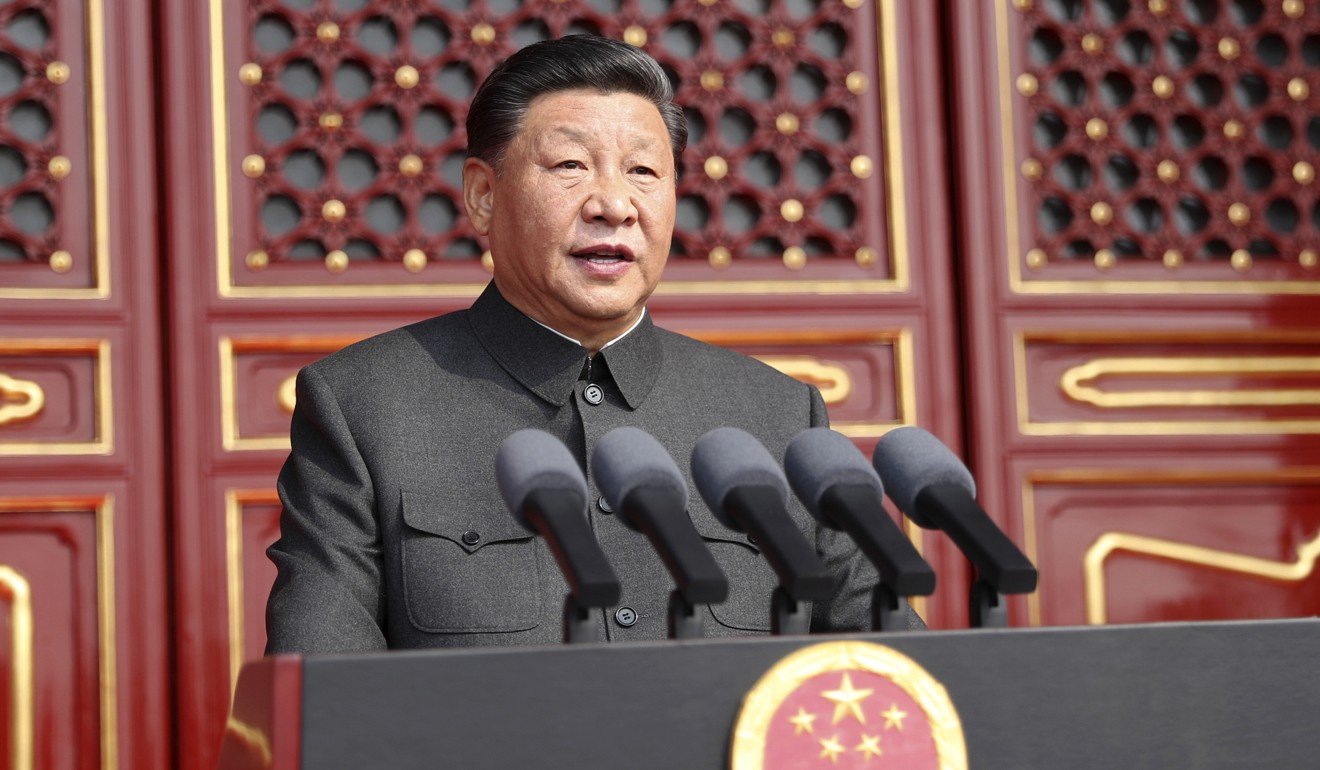

Xi Jinping has praised multinational companies for the role they have played in China’s opening up over the past four decades. Photo: AFP

Just a day after China reported its slowest ever quarterly economic growth,

on Saturday reiterated his promise to keep opening up the nation’s markets to companies and investors from around the world.

“The door of China’s opening up will only open wider and wider, the business environment will only get better and better, and the opportunities for global multinational companies will only be more and more,” he said in a congratulatory letter read out by Vice-Premier Han Zheng at the inaugural Qingdao Multinationals Summit in the east China city.

The two-day event, which ends on Sunday, was organised by China’s commerce ministry and the provincial government of Shandong with the aim, according to its website, of giving multinational companies “the opportunity to articulate their business values and vision” and “promote cooperation with host countries”.

In his letter, Xi praised multinational companies for the role they had played in China’s opening up and reform over the past four decades, describing them as “important participants, witnesses and beneficiaries”.

China was willing to continue opening up to benefit not only itself but the world as a whole, he said.

“Only when the world is good, China is good. Only when China is good, can the world get better.”

Despite its upbeat tone, Xi’s message comes as Beijing is facing intense scrutiny from the international business community over its state-led economic model – one of the main bones of contention in its trade war with the US – and its attempts to prevent foreign firms from speaking out on issues it deems too sensitive, from

Hong Kong to

human rights.

Foreign firms have also long complained about the barriers they face when trying to access China’s markets and the privileged treatment it gives to state-owned enterprises. Even though Beijing has promised to reform its state sector, foreign businesses have complained of slow progress, and just last month the

European Union Chamber of Commerce urged the EU to take more defensive measures against China’s “resurgent” state economy.

Xi promised “more and more” opportunities for global firms. Photo: AP

Sheman Lee, executive director of Forbes Global Media Holding and CEO of Forbes China, said at the Qingdao summit that foreign firms were facing a difficult trading environment in the world’s second-largest economy.

“Multinationals have seen their growth in China slow in recent years because of the growing challenge from local firms, a gradually saturating market and rising operation costs,” he said.

Craig Allen, president of the US-China Business Council, said that many multinational companies were reluctant to release their best products in China out of fear of losing their intellectual property.

China still not doing enough to woo foreign investment

In his letter, Xi said that over the next 15 years, the value of China’s annual imports of goods would rise beyond US$30 trillion, while the value of imported services would surpass US$10 trillion a year, creating major opportunities for multinational companies.

China would also reduce tariffs, remove non-tariff barriers and speed up procedures for customs clearance, he said.

Commerce Minister Zhong Shan said at the opening ceremony that China would also continue to improve market access and intellectual property protection.

The country supported economic globalisation and would safeguard the multilateral trade system, he said, adding that it was willing to work with the governments of other countries and multinational corporations to promote economic globalisation.

Xi Jinping says the value of China’s annual goods imports will rise beyond US$30 trillion over the next 15 years. Photo: Bloomberg

The promise to continue to open up China’s markets came after the

State Council

– the nation’s cabinet – made exactly the same pledge at its weekly meeting on Wednesday.

After the latest round of trade war negotiations in Washington, Beijing said it had achieved “substantive progress” on intellectual property protection, trade cooperation and technology transfers, all of which have been major bones of contention for the United States.

Despite its pledge to welcome multinational companies into its market, China is in the process of creating a list of “unreliable foreign entities” it considers damaging to the interests of Chinese companies. The roster, which is expected to include FedEx, is seen as a response to a similar list produced earlier by the United States.

Xi’s gesture would also appear to have come too late for South Korean multinational

, which announced on October 4 it had ended the production of smartphones at its factory in Huizhou, Guangdong province – its last in China – with the loss of thousands of jobs.

Source: SCMP

Posted in barriers, Beijing, bones of contention, CEO, Chamber of Commerce, China’s door, China’s State Council, closes, Commerce Minister Zhong Shan, complained, customs clearance, delegates, EU, European Union, Factory, FedEx, Forbes China, Forbes Global Media Holding, Foreign firms, guangdong province, Hong Kong, Huizhou, Huizhou City, Human rights, Intellectual property, intellectual property protection, mainland, Mainland China, Multinationals Summit, nation’s cabinet, only open wider, President Xi Jinping, procedures, Qingdao, Samsung, Samsung Electronics, smartphones, South Korean giant, South Korean multinational, speed up, technology transfers, trade cooperation, Uncategorized, United States, US-China Business Council, Washington |

Leave a Comment »