- Prototype tested last month transports high-voltage power and liquefied natural gas side by side

- It could cut the high cost and waste involved in sending energy from the far west to the east coast

Chinese scientists have developed the world’s first prototype of a superconducting hybrid power line, paving the way for construction of a 2,000km (1,243-mile) line from energy-rich Xinjiang in the country’s far west to its eastern provinces.

The 10-metre, proof-of-concept wire and liquid natural gas hybrid transmission line was up and running at the Chinese Academy of Sciences’ Institute of Electrical Engineering in Beijing last month to show the feasibility of the technology.

The line contains a superconducting wire which can transmit nearly 1,000 amps of electric current at more than 18,000 volts with zero resistance.

In a further difference from a traditional power line, the gap between the superconducting wire and the power line’s outer shell is filled by a flow of slowly moving natural gas liquefied at low temperatures – between minus 183 and minus 173 degrees Celsius (minus 279 to minus 297 Fahrenheit). This allows the line to transfer electricity and fossil fuel at the same time.

Professor Zhang Guomin, the government research project’s lead scientist, told the South China Morning Post that the voltage and current could be much higher in its real-world applications.

“This technology can take the overall efficiency of long-distance energy transport to new heights,” he said.

Existing infrastructure to transfer energy from Xinjiang Uygur autonomous region to the developed eastern areas such as Shanghai has high operational costs because almost 10 per cent of the energy is lost in transmission, according to some studies.

That infrastructure includes the world’s most advanced high-voltage power line and four natural gas pipes, each thousands of kilometres long. One of the natural gas pipelines, from Xinjiang to Shanghai, cost 300 billion yuan (US$42 billion).

The superconductor and natural gas hybrid line offered a possible solution, Zhang said.

Loss of electricity over the superconducting wire would be almost zero because of the elimination of resistance to the movement of electrons, he said.

The transport of liquefied natural gas would also be efficient, because one cubic metre (1,000 litres) of it would be equivalent to 600 cubic metres of the same fuel in gas form.

The temperature needed for liquefaction of natural gas is almost identical to that required for occurrence of superconductivity, at about minus 163 degrees.

Wang Gengchao, professor of physics at East China University of Science and Technology in Shanghai, said the combination was a “smart idea”.

Superconducting materials are not new but their applications have been limited by the difficulty and cost of creating and maintaining the low-temperature environment.

“They are trying to kill two birds with one stone,” Wang, who was not involved in the study, said.

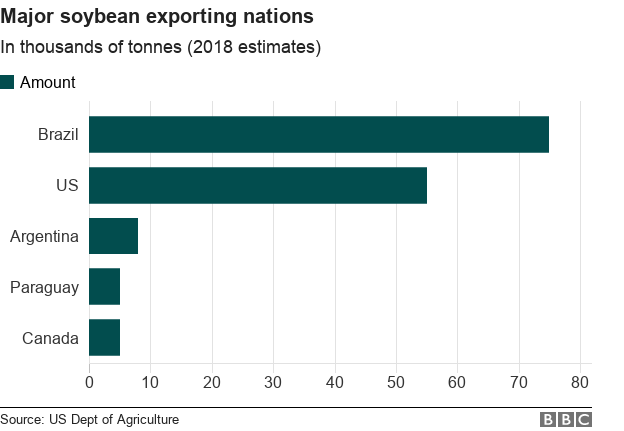

China is preparing to buy US liquefied gas and soybeans again

“But whether the technology can find a use in large-scale infrastructure depends on other things, such as safety. Not everyone will feel comfortable with the idea of putting a high-voltage electric line and flammable natural gas side by side.”

Zhang said another new prototype line, about 30 metres long, was being developed and the 2,000km project was awaiting government approval.

He said the team had solved some major technical obstacles, including reducing the risk of accidents from electrical sparks and gas leakage.

“Many problems remain to be solved, but we are confident this technology will work,” he said. “It will protect the environment. It will save a lot of land from being used for power and gas lines.”

Xinjiang has more energy resources than any other Chinese province or region. It has nearly half of the nation’s coal reserves, a third of its oil and gas, and some of the largest wind and solar farms, according to government statistics.

Source: SCMP